Newsletter Performance Review: Q4FY25

Issue #12 reviews the performance and updates of featured stocks post thier Q4FY25 results. This includes Raymond, Jindal, SAMHI, Zaggle, Garware, Kiri & Solara

The last few months have been tumultous for stock market investors. The unexpected rise of DeepSeek, the economic uncertainty from Trump's aggressive tariff policies and all the geopolitical hullabaloo.

The culmination of all these factors led to a dramatic sell-off post "Liberation Day”, where the NIFTY 50 fell by over 6% in 3 days and the S&P 500 shed 10% in two days. But the stock market has a knack of humbling investors. In a stunning reversal, the NIFTY 50 surged over 11.5% & the S&P500 17% from its lows.

All of the above plus the Q4FY25 earnings coming to an end makes this a perfect time to review and reflect.

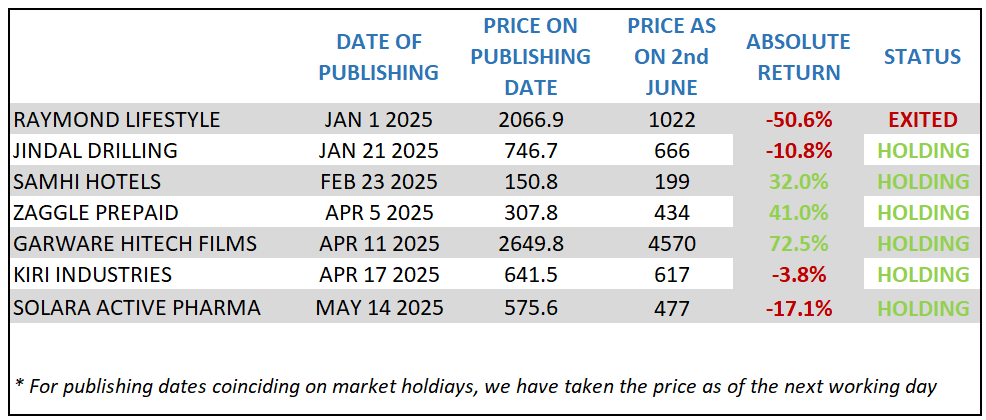

We started this blog on Jan 1, 2025. Since then we’ve featured 7 companies. For majority of these companies it has been less than 3 months since we have published, hence don’t buy in to the performance too much, yet:

On a equal weighted portfolio basis, we made +9% till date.

Against the Nifty Small Cap 250 Index we slightly underperformed:

Despite the slump, our focus remains clear:

Keep ourselves updated with the portfolio Co’s fundamentals

Analyzing the reasons behind underperforming Cos

Spotting profitable opportunities

With that clear, the following are brief updates on all our newsletter picks.

1. Raymond Lifestyle Ltd (RLL)

We exited our position in RLL on Mar 25th, 2025. You can find our exit note here.

2. Jindal Drilling & Industries Ltd.

Original Post | Q4 Transcript & Presentation

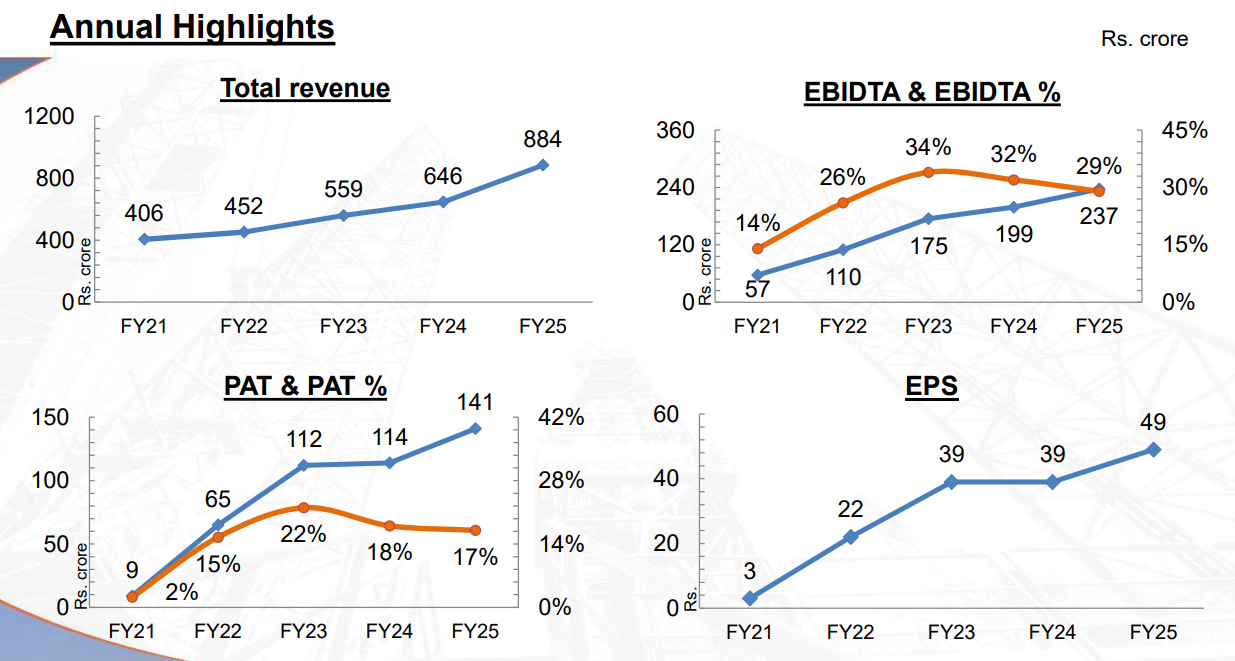

For full year FY25, Revenue & PAT increased by 37% and 26% to 884 crs and 114 crs respectively. The Co had a net cash position of 131 Crs as of Mar’25 after excluding working capital loans of 26 Crs.

This cash will be used partly for payment of Jindal Pioneer and the rest for refurbishment of the rigs once there contract ends.

The key development in this quarter was the completion of the acquisition of Jindal Pioneer from Discovery Drilling Pte. Ltd for USD 75 mn.

Major Takeaways from Q4 concall:

Mgt explained about reneging of Jindal Explorer’s contract at lower rate (USD 35.6k compared to erstwhile USD 38.8k). They explained that another bidder Gridship was desperate to get their rigs contracted and hence bidded significantly lower.

There is very less chance of that underbidding issue happening in the next tender because the concerned Co, Gridship has only 1 ship to offer in the next round of bidding.

Next year revenues will be at roughly 900 crores with 35% EBITDA margin. However management guides that it might be higher and may positively surprise shareholders.

A point which suprisingly slipped the concall but was a notable win was:

In the matter of Arbitration Proceedings between the Company and ONGC, the Arbitration Panel ruled in favor of the company to the tune of 66.33 crores. As such, the company will extinguish its Other Liabilties and recognize 100 Crs worth of profits via its P&L Account. This will lead to a one-off cash flow in FY26 (based on timing of receipt) and make the BS cleaner.

3. SAMHI Hotels Ltd

Original Post | Q4 Transcript & Presentation

SAMHI clocked a topline of ~₹1150 Crs (17.5% y-o-y) and a PAT of ~₹86 Crs (FY24: Loss of ₹235 Crs).

RevPAR witnessed a growth of 15.5% at ₹5015 for FY25. Whereas inventory witnessed addition of ~420 rooms taking the total count to ~4950 rooms.

Company’s growth pipeline remains robust with a steady addition of rooms spread across upper-upscale, upscale and midscale segments.

Major Takeaways from Q4 concall:

Partnership with GIC where the transaction is currently limited to 3 of the company’s subsidiaries that own the Courtyard and Fairfield by Mariott Bangalore, Hyatt Regency in Pune and the recently acquired Trinity Hotels in Bangalore.

GIC is to acquire a 35% stake in these three subsidiaries against a total investment of 752 Crs. ₹603 Crs for upfront debt reduction and ₹149 Crs towards capex for the Westin & Tribute portfolio. There is an exclusivity component to the deal where the platform has a first right on any acquisition of upscale hotels to the tune of 35%.

The GIC valuation stands at ~₹2200 Crs against a 134 Crs TTM EBITDA for the 3 assets. This imputes a multiple of ~16.5x which is only a slight premium to SAMHI’s current multiple.

Management guided that the debt reduction from the proceeds is expected to create 15-20% upward impact on PAT after considering the impact of minority interest.

4. ZAGGLE PREPAID OCEAN SERVICES LTD.

Original Post | Q4 Transcript & Presentation

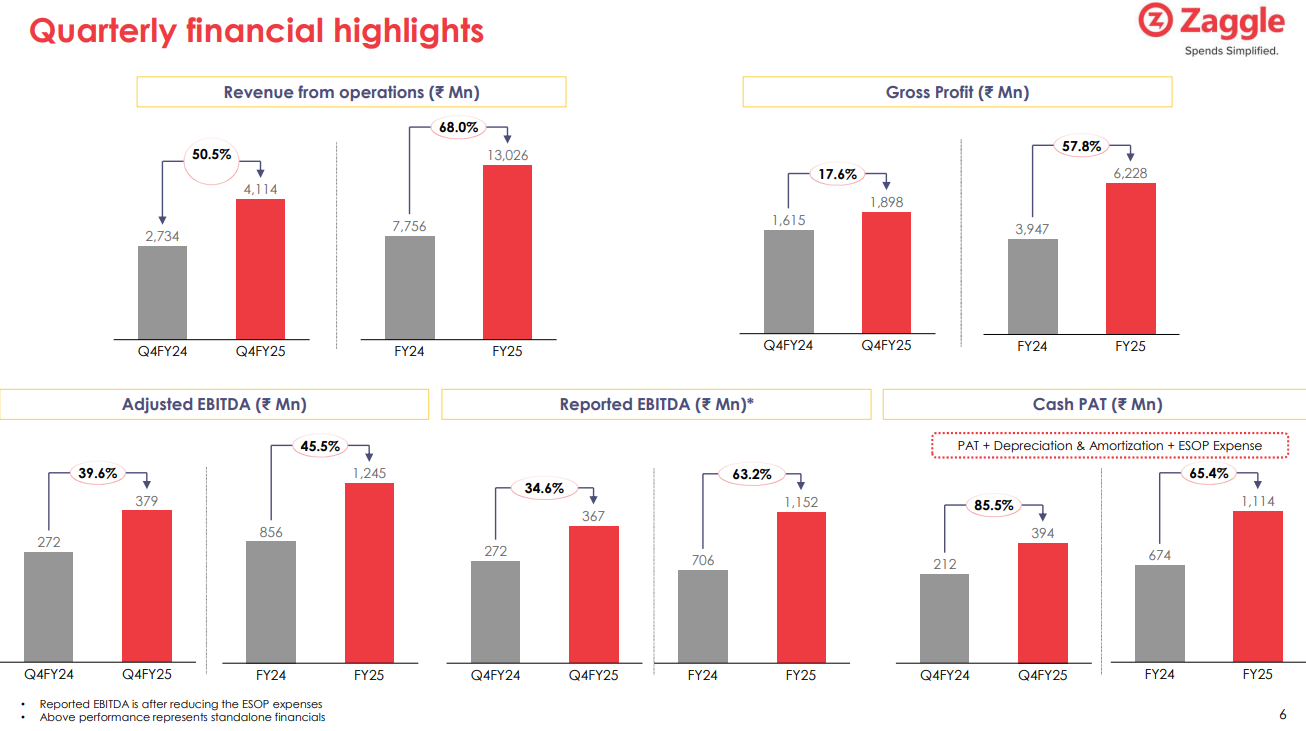

Zaggle delivered its highest ever performance in FY25 with a topline of ~₹1300 Crs achieving a 68.0% year-on-year growth. PAT also doubled from ₹44 to ₹88 Crs. It was also the Co’s highest ever quarter with ₹412 Crs of revenue and ₹31 Crs of profit.

The Co also projected organic FY26 topline growth to range between 35% to 40% and EBITDA Margin in the range of 10% to 11% which is at present 9%.

The Co is sitting on 615 Crs of cash at the end of FY25 which will be used for regular working capital purposes and the portion of the QIP money will be used for acquisitions. The Co continues to explore M&A opportunities in adjacent spaces in domestic and international markets with a focus on opportunities in payment solution, loyalty management, merchant card software etc.

Major Takeaways from Q4 concall:

Launch of Zaggle Unified Gig Worker Savings (ZUGS) which would help low income blue-collar workers claim tax refunds that could amount to nearly two weeks or more of earnings, a sizable amount for nearly 20 million blue-collar workers in the country. For this product, the Co’s acquisition of TaxSpanner will play a huge role.

An analyst asked about the status of the quick commerce deals and by when they would scale up. To which management replied that large accounts take time to scale up. There is both adoption and education required and also confidence required by the CFO and their team that they are able to control the spends. It usually begins with 100 stores going live.

Then the system is checked for stability and other types of issues. Post solving them the scale goes to 500. Check for issues again, fix them and then maybe expand to 3000 stores. Three of these large quick commerce accounts are live.

5. Garware Hi-tech Films

Original Post | Q4 Transcript & Presentation

Garware posted exceptional results with ~26% growth y-o-y in revenues and PAT growth of 63% for full year FY25. Growth was majorly driven by SCF and PPF which annually grew by 38% and 25% respectively.

2500 Cr sales growth guided for FY26 and 20-25% EBITDA margins till FY27.

Two expansions ongoing. First the new PPF line to be operational by Q2 FY26 followed by the TPU extrusion for Q2 FY27. The details of the same can be found in the investor’s presentation.

Major Takeaways from Q4 concall:

Mgt guided that commodity prices such as petrochemicals may have as little as 20% impact on the prices due to the immense backward integrations specially after the new PPF line (I guess he meant TPU line).

Second many of the products which are made in IPD is supplied to the CPD side which also garners growth for the IPD line. Also management guided that any product additions in the future will be high margin products.

6. Kiri Industries Ltd

Kiri has finally found a buyer for its stake in Dystar and it is none other than Zhejiang Longsheng Group. On May 29, 2025, Zhejiang Longsheng entered into a Share Purchase Agreement (SPA) with Deloitte & Touche LLP, acting as court-appointed joint and several receivers, and Kiri Industries.

Under the terms of the agreement, the Longsheng has agreed to acquire Kiri’s 37.57% stake in DyStar Global Holdings (Singapore) Pte. Ltd., for a consideration of USD 676.2 Million. An additional consideration of USD 20.3 million would be payable by Longsheng to address any shortfall in the base consideration or to fulfil its obligations under the SPA.The long-stop date for the fulfilment of the conditions in the SPA is scheduled for October 2, 2025, and may be extended, if required, up to November 3, 2025.

In SPA, the date by which the conditions must be satisfied (or waived) for completion to take place, so as to impose ultimate certainty as to completion of the transaction is known as the long-stop date.

We also poured into the finacials of Longsheng to check whether it has the capacity to pay. We found that Zhejiang Longsheng Group is a profitable, well capitalized Co. As per its Dec’24 Balance Sheet the Co had equivalent of USD 2.5 Billion of cash, had Debt-to-Equity of 0.64 and a healthy current ratio of 1.71. Net operating cash flows was healthy at USD 1.3 B for FY Dec’24 and was positive in all of the past 5 years (inc. the COVID years). Although revenue was flat in the last 5 years (2024: USD 2.1 B), the Co was profitable throughout. In a nutshell, Longsheng can pay.

7. Solara Active Pharma Sciences

Original Post | Q4 Transcript & Presentation

Solara posted flat y-o-y growth in operating revenues at 1284 Crs for FY25. The Co clocked EBITDA of ~217 Crs compared to negative EBITDA of ~92 Crs in FY24. The Co reported a PAT of a single Cr compared to 517 Crs of loss in FY24.

The Co. significantly missed on revenue and EBITDA guidance due to a challenging year of intense competition on Ibuprofen range of products. EBIIDA margins expected to be around 20% in the next 2 years.

Overall contribution of revenue from regulated markets is 76%. The Co is focussed on Ibuprofen derivatives and incremental capacities in high margin products.

Major Takeaways from Q4 concall:

Regarding the Ibuprofen issue management explained that there is presently excess capacity in India coming from new plants with newer technologies. And the routes of synthesis for these players are far more efficient.

The pricing that currently prevails in the market for Ibuprofen is less than the Co’s manufacturing costs and hence investing more working capital in a biz which does not add value makes no sense. Also, adapting newer technologies in the Ibuprofen business would lead to big regulatory changes in their clients files and given the Co wants to retain 100% of them, investing more is prohibitive at this time.

Apologies if this has been a long read. For detailed updates, we urge you to visit the linked presentations and earnings transcripts.

For us this journey has been enriching and has made us more disciplined in the review process. We will continue to update on new opportunities, track and reshuffle existing opportunities and iteratively strengthen our R&A capabilities.

We pour through a lot of companies. However, we seek strong evidences of undervaluation and earnings growth adjusted for management and balance sheet quality, before we invest in one.

We truly believe that this approach can make us better investors and enable us to pick multi-bagging winners in the long term.

Cheers!

Hi Arun Ji. Thanks for your addition. In line with other commentaries, what we have written is from a business risk perspective.

The fact that some competitors have newer technologies which gives them a cost advantage is a fact. By some estimates, generic Ibuprofen still amounts to 1/3 rd of Solara’s revenue and including Ibuprofen derivatives is close to 45%. The later part was stated in the concall.

Whether the promoter focuses on branded pharma is different. But the fact still remains that close to half of sales comes directly/indirectly from Ibuprofen. Hence continued pricing pressure has high likelihood of hurting margins even in the future.

The promoter may/may not spin stories about diversifying. Till the time he doesn’t we have to be critical given this disadvantage compared to competitors.

That is the perspective it was written from. Hope it clarifies.

Regarding major takeaways point 2. You ought to have given more context. Mr Arun mentioned about not chasing new tech has two main reasons 1. His statement from the conference call implies that the newer tech caters to generics while they cater to branded pharma with a 25 year relationship. This statement implies better price realization from their existing customers. 2. Higher cost of regulatory compliance if new tech adopted.

To me what you wrote, implied a structural shift in ibuprofen market (which maybe the case - not fully investigated). Do you think this has any material negative impact on their ibu business?