SAMHI Hotels: Your portfolio's next reservation?

From losses to ~₹150 Cr profit by FY27: #Issue 03 explores SAMHI's hidden earnings catalysts that are driving its turnaround

SAMHI is a core holding in my portfolio. My average price on this stock is ₹204. As of 21st Feb’25, the stock is down by ~25% at ₹153. Good for me as this may present a further buying opportunity!

This post is going to be a bit different. I had written in depth on SAMHI in last Nov which you can find here. The purpose of this article (atleast personally) will be to build even more conviction by:

⚡Visiting material events that occurred in the past months

⚡Revisiting risks more thoroughly

⚡Sketching valuations estimates at current prices

Without further ado, let’s check in.

Since I wrote on SAMHI on November the following material things have occurred:

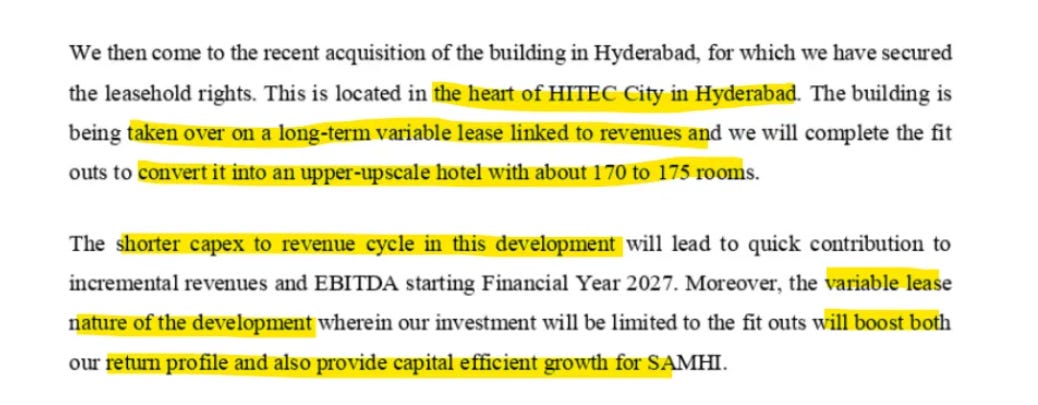

The Co. signed a long-term variable lease for an existing building in the heart of HITEC City, Hyderabad, which will be converted into a 170-room upper-upscale Marriott (Westin) hotel.

The Co. as a part of its recycling strategy sold 100% of its wholly-owned subsidiary Duet Chennai OMR for a consideration of ~₹54 Crs.

Results for Q2 & Q3 FY25 came in along with thier concall transcripts which gives more information about what’s going on.

The following are some of the key points from the Q2 & Q3 concalls:

Near term Revenues

Holiday Inn Delhi had one month of operation in December. While Holiday Inn Kolkata & Bangalore were fully ready and were awaiting final approval in the next few weeks as of Jan’30. So revenue from all three can be partially expected in Q4 and fully from Q1 FY26.

The ACIC portfolio has transitioned from franchise to managed under Mariott. Hence management is expecting higher margins (increase of 100-120 bps) and revenue during the subsequent quarters.

54 rooms in Sheraton and 22 rooms in Hyatt Regency Pune shall be completed in FY26 and stabilization timeline will be rapid since these are operational properties.

Long-term strategy (3-5 years)

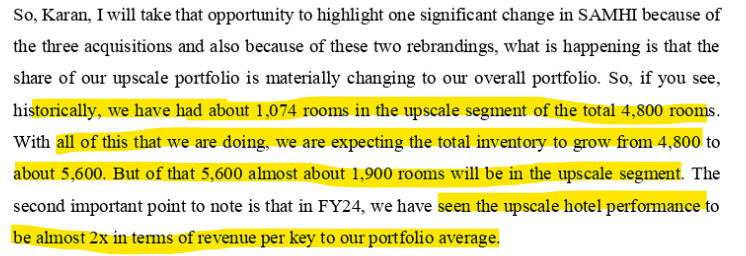

Post completion of these projects, the Co will see a reconfiguration in its portfolio mix where there will be a higher share of upscale rooms where revenue per key is twice that of the portfolio average. Once completed the share of upper upscale room will increase from 22% to 34% of the total portfolio.

Estimated Capex

Capex plan in summary is 200 to 220 crores in FY 26 followed by 150 crores each for a FY 27 & FY28. All of this are to be ideally funded by about 100 crores from internal accruals and 200 crs from asset recycling.

Describing its asset recycling strategy, management explained:

It further clarified that it will be recycling mid scale assets to the tune of 200-250 rooms from where revenue and EBITDA are minimal and where the capital finds better ROI elsewhere.

Valuations

SAMHI is currently trading at a PE of 71x but that is just optics given its low earnings base.

Imputing intrinsic valuations require a visibility of future earnings. In the Q1 FY25 earnings call, management stated that it expects a 25% growth in EBITDA by FY27 over its FY24 base i.e. 500 Crs of EBITDA by FY27.

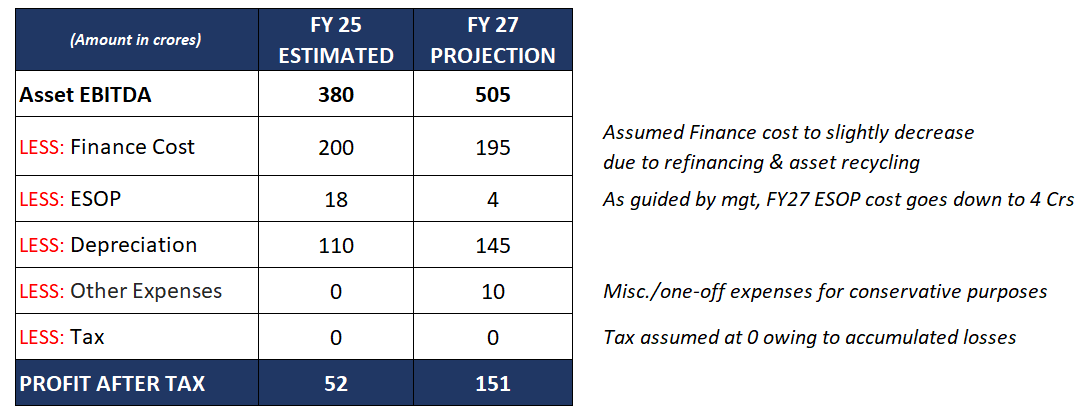

For a moment let’s challenge this assumption and work out the EBITDA on our own. Assuming revenue for Q4 FY25 the same as last year, we get a TTM FY25 revenue of 1100 Crs. Assuming this FY25 revenue grows at a meager rate of 5% p.a. till FY27 will yield us a revenue of ₹1215 crores from existing assets.

Add to this the 3 Holiday Inn hotels (300 rooms) and 66 rooms in Sheraton Hyderabad and Hyatt Pune which will fully stabilize and be operational by FY27. Assuming a 70% occupancy rate, 360 working days and respective (midscale and upscale) ARRs given in the Q3 investor presentation, we estimate an additional revenue of ₹40 Crs.

SAMHI also intends to complete the conversion of Four Points Pune and Caspia Delhi properties (~350 rooms) to Courtyard and Fairfield Marriott respectively by FY27. Additionally, within the same timeline lies the conversion of the recently leased office building in HITEC city to a 170 room W hotel. However, execution/operations might be delayed or stabilization may take time hence we only estimate a nominal ₹5 Crs from these properties combined.

Combining all the above, we get a conservative estimate of ₹1260 Crs of revenue by FY27. Assuming a 40% asset EBITDA margin, we get get an EBITDA of ~505 Crs. The EBITDA margin is in line with what management observes as given by the samestore margins below.

My own excel sketch estimates puts the FY27 PAT at 150 Crs. At the current market cap of ~3400 Crs it imputes a FY27 forward PE of 23x which is a decent valuation.

As per Screener, the median PE amongst a universe of 46 hospitality companies is 37 which I think will be retained over the medium term given the supply constraints in the industry. Hence, even if SAMHI is valued at a lower PE of say 30x, we could see an upside of 33% in the next 2 years.

If rerated at a slightly higher PE multiple of 33x, the return could be as high as ~48%, which I believe is very decent in a down market.

This seems like a comfortable valuation especially because if the ~500 upper upscale rooms (refer 3rd point where we estimate 5 Crs revenue) are even partially operational and stable, SAMHI could potentially see a huge earnings jump in FY28.

However, when buying at current levels, I would take a staggered approach to investing and not put the entire capital at one go, given the current downtrend in the markets.

What can spoil the party?

Not much has been written about the aspect of risk in SAMHI. I have been guilty of the same in my earlier LinkedIn article. Here’s my effort in rectifying the same. So what could prevent SAMHI from realizing its expected potential. Quite a few things actually:

High debt levels: SAMHI had a debt to EBITDA of 4.5x as of 31st Dec’24 which management intends to reduce to 3.5x by FY26. Regular term loan payments, one-off payments via asset recycling and extra payments from incremental cash flows should help deleveraging.

Many investors believe this high leverage prevents SAMHI from getting good valuation rerating in the form high PE multiples. For example, Indian Hotels trades at a PE of 70x given a low debt-to-equity of 0.29 compared to SAMHI’s 2.07x.

Cyclical nature of hotel industry: No surprises. The industry is already enjoying peak occupancy rates at 72% and this is unlikely to inch much higher. RevPar growth has also been healthy in the past few years across midscale to upper upscale hotels and will likely to increase in mid-single digits in the next few years.

SAMHI uses its own macro indicators of air traffic growth and office space expansion which have been healthy and growing (refer slide 5 & 6 of Q3 FY25 presentation). But given we live in an uncertain world the risks of a downturn can’t be discounted as much. All that said the Co does derive comfort as it primarily operates in business markets as opposed to leisure markets which are much more cyclical.

The post-IPO 18-month lock-in period for institutional shareholders will be over in March 2025. Depending on the stock price at the time, we might see some profit booking at that time which can depress prices. However, this may be a temporary blip and if prices and fundamentals remain strong, this shouldn’t be much of a concern.

SAMHI hotels is not directly comparable to Cos such as Indian hotels or Lemon tree because it does not control its own brand or marketing. SAMHI essentially contracts brands like Marriott, Hyatt and Sheraton to run its hotel for a management fee. It does not have its own brand which limits any franchise value or asset light scalability in the future (apart from owning hotels via variable leases). It is better compared to a REIT where free cash flows are redeployed in growth rather than being distributed to investors.

Final conclusion

Investors should exercise caution when investing in hotel stocks. Hotel stocks present a double whammy risk of being asset heavy and cyclical. At the bottom of the cycle, the sector sees very low capacity addition coupled with high debt. As the cycle starts to improve, a combination of operating leverage and high ARRs lead to efficient operating metrics and high operating cash flows. These cashflows are in turn utilised to pare debt and improve the financials.

The past 7-8 quarters of good results is not an indication that the part will continue forever. However, we derive comfort given SAMHI operates in some of the strongest and growing business cities in the country. In my assessment if the company can sustainably generate operating cashflows and can pare its debt, the market is likely to rerate it higher.

That being said, good fundamentals can’t withstand if there is a drain on liquidity in the small cap segments. However, if looking to add exposure to the hotel sector where most of the well known names are already priced in; Samhi Hotels offers a decent risk-reward ratio in the current context.

These are my views on SAMHI Hotels Ltd. This is NOT an investment advice, just perspective. My opinions might change anytime and I would not be obliged to update the same here. So please do your own research before making a buy/sell decison.

Hotels on this scale do not fetch PE multiples. If we assume a conservative EV EBITDA of 12 and 500cr of EBITDA would give 6,000 cr EV. Less say 2000 cr of debt gives 4,000 cr of Market cap, implying 20% upside in 2 years form current market cap of 3400 cr.