Jindal Drilling: Riding the offshore Oil upcycle

Issue #2 explores the sustained upcycle in the offshore Oil & Gas segment and why Jindal Drilling is poised to ride the tide.

Jindal Drilling & Industries Ltd (JDIL) is a service provider in the upstream segment of the offshore oil & gas industry. The company provides rigs on charter hire basis to ONGC (which is its sole client as of date). The Co. is part of the DP Jindal group which also operates Maharashtra Seamless Ltd.

JDIL operates 5 jackup rigs which are currently with ONGC. A jackup rig is a specific type of an oil rig which drills oil from the earth’s surface. These rigs can be located either on land (onshore) or water (offshore). Jindal Drilling has a fleet of jack up rigs dedicated to offshore drilling which extracts oil from shallow water ocean beds.

Jack-up rigs are floating structures that can be moved to different locations and are used for drilling oil or natural gas. These rigs operate in calm, shallow waters upto 350 feet deep but are capable of drilling 30,000 feet into the seabed. An image of Jindal Explorer (one of JDIL’s rig) is given below:

As mentioned, JDIL operates a fleet of 5 jackup rigs currently on service with ONGC. It also owns another rig (Jindal Pioneer) via its JV which is deployed in Mexican waters and operated by another oilfield services company, Saipem. 2 of the 5 rigs are owned and the others are rented. It makes the highest EBITDA margins on the owned fleet. Jack-up rigs have a typical life of 30-40 years which can be enhanced by significant periodic rehaul and refurbishments (as in the case of Jindal Supreme). Modern rigs have lower operating and maintenance costs and are more readily acceptable by E&P companies such as ONGC.

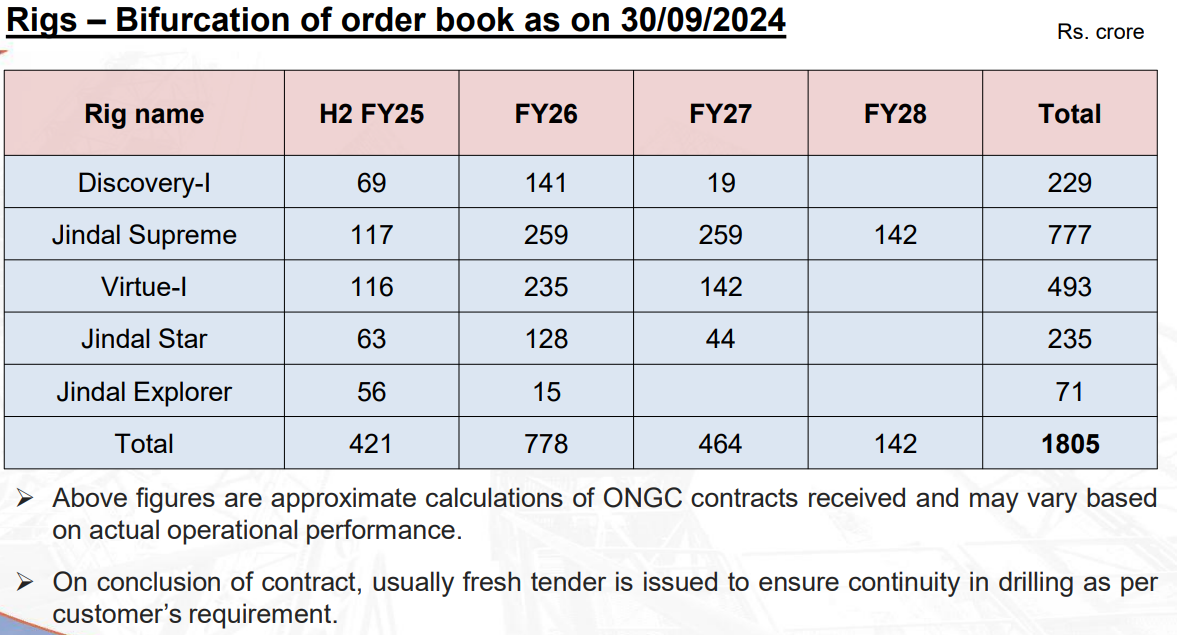

JDIL rents out these rigs for Exploration and Production (E&P) purposes to ONGC on daily rental rates. The following is the approximate order book of the company as on 30/09/2024:

Order book of rig Jindal Pioneer has not been considered as it is currently owned by the JV company. Brief details of all the rigs can be found here.

I believe JDIL has good prospects for strong earnings in the medium term. The current demand-supply dynamics of the offshore oil and gas industry (discussed below) presents an opportunity for high daily rental rates. As seen from the table above, Jindal Supreme and Virtue 1 had recently recontracted with ONGC at much higher rates (~2x). Coupled with expected upward reneg on Explorer’s day rates post contract end in May’25 (new rates to kick off by Sept’25) + potential acquisition of Pioneer from JV (discussed later) would entail a sustained, higher EBITDA.

If this upcycle sustains post H1 ‘26, contracts for Jindal Virtue and Star will also be reneged at higher prices.

The Offshore Oil & Gas Industry

Oil prices have fluctuated wildly over the decades, but here’s a quick summary since the start of this century. Since 2003, growing demand from emerging economies of China, India & Brazil among others pushed oil prices to a peak of $144 per barrel by July 2008. Only to see it tumbling down to $40 per barrel by December 2008, courtesy the GFC.

Economic recovery picked pace in 2010 and coupled with the Arab Spring uprisings (markets fearing cuts in production) oil prices stabilized at $100 per barrel during 2012-14. However, oil prices began to decline in late 2014 due to excess supply, driven by shale oil production in the United States. At the same time, Saudi Arabia decided to defend its market share by maintaining OPEC's production levels in the hope of forcing U.S. producers to reduce their output, thus creating a standoff.

All this led the price of Brent to slip below $30 a barrel in January 2016 to levels not seen since 2003. Just as prices began to slowly recover, touching the $75 per barrel mark, COVID-19 hit and brought the entire oil and industry to its knees.

Due to being in a capex heavy industry, offshore drilling companies are particularly supeceptible to sustained downturn in oil prices. Many companies were on a huge spending spree leading upto that period, heavily investing in everything from submersible and deep water rigs financed by ‘shiploads’ of debt.

The costs of these rigs widely vary depending on various factors such as rig type, drilling capabilities, operative water levels and the technology required. An offshore jack-up rig which can be deployed in ocean depths of up to 400 ft costs can cost between 180-220 mn USD. Semi-submersible rigs which can drill at depths of 1500-3,000 ft can cost as much as 500 mn USD and drill-ships which can drill at depths of 10,000 ft can cost as high as 800 mn USD.

The offshore rig industry thus went through tough times when the oil industry went through the extended downcycle from 2014-21. The excess supply of rigs against a protracted demand downturn was worked off through bankruptcies, debt restructurings, mergers and asset retirements.

46 exploration and production companies and 61 oil-field service companies filed for Chapter 11 bankruptcy in 2020, according to Haynes and Boone, a Dallas law firm tracking bankruptcies. The 107 oil and gas bankruptcies in 2020 were the most since 142 bankruptcies were filed during the last oil bust in 2016. The names included some of the largest offshore drilling companies in the world such as Valaris, Seadrill, Noble Corporation, Diamond Drilling, Pacific Drilling etc.

Referring to asset retirements, this period saw many offshore rigs being cold stacked (complete deactivation of rigs) to save running costs. It takes considerable time (4-9 months) and capital ($10-15 Mn, the bill goes up the longer a unit has been out of action) to get cold stacked rigs back up to working condition, and many older rigs getting scrapped as the higher maintenance costs stopped making sense.

An article from Westwood Insight stated:

From 2014 to 2018, during the deepest period of the rig market downturn, there was a yearly average of 43 rigs – jackups, semisubmersibles (semis) and drillships – permanently removed from the active fleet, mostly through scrapping or conversion for non-drilling purposes. Rig demand began to show signs of improvement during 2019. However, in 2020 the coronavirus pandemic obliterated rig demand and with it came a 35% jump in rig attrition against the previous year. Between 2020 and 2021, the average age of rigs being retired fell to an all-time low, and during this time we saw drillships as young as eight years old being removed from the active fleet.

Post the chronic downturn from 2014-20, a rig market upcycle began in the latter half of 2021; which is still persisting today. We will try to systematically understand the drivers from the same and the present state of the cycle. Let’s begin with offshore spending:

Offshore Spending

Offshore accounted for about 29% of total global E&P spending in 2022, in line with the long-term average of 30% going back to 2003. In 2022, offshore spending grew an impressive 21% to $148 billion led by growth in Latin America (LatAm; 31%; includes Guyana) and Asia-Pacific (APAC; 21%).

A further granular view of Asia Pacific also indicates rising E&P capex in the medium term.

Drilling and well services are major portions of the global E&P capex which basically become revenues for drilling services cos like JDIL. These services as a % of global offshore spending is expected to remain higher than the long-term average of 42%.

The demand-supply scenario for jackup rigs

The painful downcycle starting 2014-2021 has had a structural effects in the capital allocation strategies of the E&P cos. Erstwhile these companies had a propensity to overspend and undertake E&P projects that had potential for lucrative return on capital. But since the downturn and consequent bankruptcies and reorganizations cos are cautious when committing to undertake E&P projects. Especially due to the long-term nature of the investments and uncertain long term oil demand given the global boom and push for renewables.

This disciplined attitude has a brought a change in strategy where these E&P cos instead of building new assets (rigs) are increasingly hiring working-condition assets at charter rates. And given the limited supply of these assets (as we will see in a bit), the dayrates for these rigs are likely to be high in the near to medium term.

As of 2022, the estimated floater supply of 191 was about half the supply at the peak in 2014. Furthermore a recent data from Valaris’s report, shows a utilization of 82-90% for jackup rigs, with very little in the way of new builds:

At present times, supply has been tight. Though marketed utilization for jackups and drillships have stabilized clear above 90% since early 2023, and day rates have more than doubled to $150,000 and $500,000 respectively for the two rig types, it has yet to trigger a construction-led supply response.

Plus, >40% of the existing global fleet of jackup rigs are over 15 year old which means they do not come inbuilt with the latest operational technology.

~25% of the

Globally, day rates for jackup rigs have inched higher since 2021, on the back of high oil prices, healthy offshore spending and discipline around incremental rig supply.

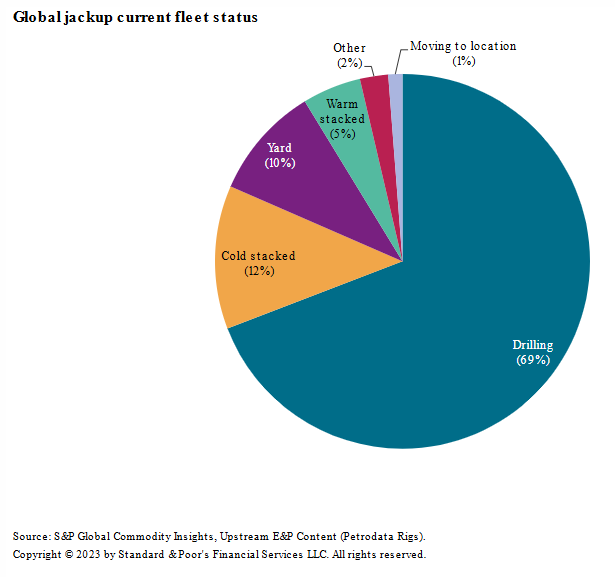

~27% of jackup rigs globally are cold-stacked, yarded or warmstacked. The warm-stacked rigs would be the first candidates for reactivation given the lower reactivation expense compared to cold stacked rigs; which however represents only ~5% of the supply.

Disclaimer: Note that the above industry analysis was of the global jackup fleet and is dated as of 2023-24. My assumption is that the demand-supply scenario in India broadly approximates global trends. Also given the strategic nature of assets and India’s high import dependency, ONGC is unlikely to let JDIL’s fleet be employed in international waters.

The Indian jack-up rigs market

As of August 2024, there are 37 contracted jack-up rigs operating in Indian waters, the majority of which are contracted by ONGC. Of these, 32 rigs are leased by ONGC from third-party providers like Jindal Drilling, while 5 are owned and operated directly by ONGC. In addition to ONGC, smaller E&P operators such as Reliance, Cairn Oil and Gas (Vedanta), Oil India, and HOEC also occasionally contract jack-up rigs.

The primary players in India’s jack-up rigs market include Shelf Drilling, a global MNC currently operating 9 jack-up rigs; Jindal Drilling, which owns 4 rigs outright or through JVs/related parties and operates 5 rigs; and Greatship India Limited, a subsidiary of GE Shipping, which owns and operates 4 rigs. Jagson International also owns 4 jack-up rigs; however, these are older models built between 1975 and 1982. Similarly, Aban Offshore owns 4 rigs but is facing significant financial difficulties, including negative net worth, limiting its ability to compete for new rig contracts.

Recent News

a) Westwood’s group prediction for the Offshore drilling industry. Short summary:

Offshore drilling upcycle to continue but 2025 will be a year of market correction

Postponed projects will soften demand globally but growth is expected in areas such as Latin America, Africa & India.

Among the types of drilling rigs, semi-subs will be the hardest hit as they fall out of favor against drilling ships. At the end of 2024, 6 ships have been retired and no new ships delivered thus decreasing the overall supply. (All 6 rigs of Jindal are jackup fleets so comparitively lesser demand stress.)

Dayrates are expected to witness some softness. However, day rates for jackups and drilling ships are expected to be maintained at the 2024 average.

b) Biden just permanently banned oil and drilling across 625 million acres of US coastal territory as on early January 2025. From what I understand existing contracts are operational but prospects for new contracts are prohibitive. This is supposed to cause a surge in oil price in the medium term; with depleting supply from existing oil wells not being replaced with fresh ones.

Expect volatility in near term. As long as oil prices are higher than $60 concerns should be broadly limited.

c) ONGC spooking the Indian jackup rigs market by cancelling/postponing negotiations to re-hire 7 jackup rigs. Insider speculate this is a move by the company to bring down daily hire rates for the rigs.

d) Saudi Aramco’s cutback on oil expansion in H1 FY2024 which led to temporary suspension of operation of 22 jack-up rigs.

The near-term outlook in JDIL

As of September 30, 2024 JDIL had the following orderbook, displaying strong earnings visibility over the next 2 years:

However, this orderbook does not reflect a few the near term earnings driver at play:

Jindal Supreme: Supreme is one of JDIL’s key assets. It’s earlier contract with ONGC ended on March’24 and after about 6 months of refurbishment and negotiation, JDIL reneged to a ~2x rate for the next 3 years which started on Oct’24. Under the new contract, JDIL has been rented out at a fixed day rate of $88,859 to ONGC compared to an earlier rate of $40,700.

Jindal Supreme is one of JDIL’s two owned assets. Under its earlier contract of $40,700 the company clocked an EBITDA margin of 10%. So almost all the incremental EBITDA from the new rate will flow to JDIL’s bottomline. I estimate ~40 Crs worth of EBITDA flowing into JDIL.

Given Jindal Supreme is an old asset (built in 1975), it had to go through repairs and refurbishment before it could be redeployed. Based on management guidance (Q2 FY25 concall) I estimate the company has spent ~150 Crs in refurbishing the rig which has been capitalized by the company and will be ammortized over a period of 3 years (12 Qs). Assumming 15-20 Crs have been ammortized in H1 FY25, the quarterly refurbishment ammortization expense will be ~15 Crs for the next 12 quarters.

Subtracting the refurbishment expenses from the gross EBITDA, we get a quarterly net EBITDA of ~25 Crs starting from Q3 FY25 onwards.

Jindal Explorer: The contract for Jindal Explorer (ss of orderbook dates given above) ends on May’25 but may be extended till August or September’25. Explorer is a relatively newer build (2014) and is presently operating ($38.8 k) close to Supreme’s earlier rate of $40.7 k. Given the current demand for rigs, it is likely to be reneged at higher prices. Almost all of the incremental EBITDA from the new rate will likely flow to JDIL’s bottomline; although after a few months of hiatus and refurbishment expense as explained in Q2 FY25 concall.

Assuming the rig starts opertaing at the new rate from Dec’25. Say at a modest day rate of $60 k (compared to Supreme) and refurbishment cost of 100 Crs over the next 3 years starting Jan’26. That would give us a net quarterly EBITDA of 8 Crs.

Purchase optionality in Jindal Pioneer: Jindal Pioneer is owned by JDIL’s JV entity Discovery Drilling where Jindal owns a 49% share of the JV. The rig is currently on rent with Saipem and is deployed in Mexican waters at a bareboat charter of $35k per day which will increase to $40k by Jan 2025. A bareboat charter contract is where all operating costs are borne by the operator and thus almost the entire day rate flows to EBITDA and subsequently PBT. Given JDIL’s 49% share of the JV, it reports INR 9-10 Crs of PAT per quarter.

As guided by management in the last couple of concalls, JDIL is in the process of buying out Jindal Pioneer from the JV entity for a net consideration of $45 million. As of 30th October’24, the transaction has been approved by the board and shareholders and only certain regulatory approvals are pending.

JDIL is required to pay $75 million to purchase the rig, however the company from which it is buying has taken ~$30 million of loan from JDIL. As per management, as part of the agreement the debt will be extinguished and JDIL will be required to pay a net proceed of $45 million. The payment will be done in a staggered approach and thus enable the company to fund the purchase via internal accruals and available cash balances. Cash and equivalents stood at INR 164 Crs against long-term obligations of 70 Crs as of 31st March’24.

If this purchase comes to fruition, the company will net INR 18-20 Crs of PAT per quarter before paying for the rig. For conservative purpose, I will assume the entire PAT will be used to payoff its staggered payments in the near term. Despite JDIL’s balance sheet will be bolstered by the new asset.

Valuation

As per estimates the projected PAT for JDIL would be:

Baseline standalone PAT of 32 Crs (as of Q4 FY24).

PAT of 15 Crs from Jindal Supreme

PAT of 5 Crs from reneged day rates on Jindal Explorer

Adding the above three we get ~50 Crs of quarterly PAT or ~200 Crs worth of annual PAT. As of 21st Jan’25, the Co’s market cap stands at 2166 Crs which imputes a 1 year forward PE of ~11x which looks reasonable.

Also a major portion of the loans would be paid off in the next couple of years (read: borrowing foot notes in AR FY24) and some intercorporate loans and advances would be extinguished (such as post Pioneer acquisition). This low indebtedness would impute a gradually increasing ROCE which may over and above justify a 11x forward PE.

Risks: What may sink the Bet

Oil prices falling down from a cliff. For reasons such as Donald Trump, higher fracking activities, OPEC witholding production cuts, COVID like crisis, fall in global demand etc. This is a serious risk and not just a formality. History has shown many a fortunes of individuals and institutions have drowned in oil.

Major players stagnating spends on E&P activities due to uneconomic oil prices (point 1) or their own financial difficulties. The whale in the sea is definitely ONGC in this case, as Jindal’s orderbook and future outlook is fully committed to them (super high concentration risk). Decreased/delayed spends can lead to revenue risk and lower asset utilisation for Jindal Drilling.

Jindal is a decently capitalized company but has a contingent liability of ~160 Crs agisnt ONGC pending final order from Supreme Court (Refer page 1, para 5 of Crisil’s Credit rating report dated July 1, 2024). 50% of this contingent amount (~80 Cr) is held as FD by the Company in anticipation of the final order. In addition, intercorporate loans and advances are a key monitorable. As of FY24, loans, advances and receivables to subsidiary and JV Cos consisted of 463 Crs of RPTs. Promoter remuneration was to the tune of ~6 Crs.

Although, the company has been in the business for 35 years, it still faces an execution risk in terms of renewing contracts, fulfilling contract obligations with ONGC and repairing and refurbishment within stipulated time and costs. In addition, high working capital days (~4 months) which is intrinsic to the industry is a key monitorable as well.

Risk initiated with oil prices dropped. Stock price dropped sharply on Apr 2. Where will it heading now despite good fundamentals