Zaggle Prepaid: A high growth play on Corporate spendtech

Issue #6 explores the playbook of a leading player in the spends management space. Is the unique business model, growth drivers and risk worth the price.

Hi everyone, its been a pleasure curating and presenting research on small caps for you.

Besides quality of research, a part of this blog is a continual effort to improve the way information is presented; in terms of both value-addition and usefulness. The genre of this blog is not of recreational reading; but the kind which you’d use to complement your own research or return for a one-shot recap in the future.

Keeping this in mind, we at first, have exhaustively deep dived into the product (to the point of boredom), something which I did not find anywhere. Especially because it is super-important to understanding the future prospects of the company.

At first glance, the business model is exciting but a bit hard tricky to understand. Hence, most people carelessly throw words such as operational leverage, SaaS, non-linear etc. without looking deeper. This post is an effort to make you understand all that business in the very first read and refrain from unecessarily hyping up the stock.

Without further ado, let’s look into the business of Zaggle Prepaid Ocean Services Ltd., India’s ‘only listed profitable fintech company’.

Zaggle is a uniquely positioned fintech platform in India, providing software and analytics solutions around the expense side of the P&L. It provides an integrated spend management software around various heads such as indirect employee spends, travel expenses, payments and rewards management.

Zaggle primarily operates via three segments: Propel, Save and Zoyer. Let's understand them slowly, in detail as it is the key to recognize the investment thesis:

Propel - Rewards and recognition platform for employees.

Employees earn reward points for a variety of reasons. This could be a long service award; could be a pat on the back where somebody is given an instant reward; could be performance linked rewards or even for festive occasions like Diwali or New Year.

These reward points (known as Propel points) based on performance metrics are defined on Zaggle's platform. These metrics in turn are fed into Zaggle's platform via the HRMS system which is automatically updated via an API integration. The platform is a single sign-on and any employees that gets added or deleted in the HRMS system automatically gets added or deleted in the Propel platform.

Employees who earn these points redeem them for vouchers of over 300 brands, brands like Amazon, Shopper Stop, Tata CLiQ etc. And Zaggle gets paid by the employee's company for the points that get redeemed. When the vouchers are given to the employee, Zaggle earn commissions from its merchant partners. So, let's say certain reward points are given to employees and he/she has chosen to redeem for Shopper Stop vouchers; in which case the Co has a take rate of about 10% - 15%.

Save: Expense management and employee reimbursements

In the mobile app, the employee goes ahead and scans for bills for any expenses that they incur. So, let’s say there is an employee who travels from Hyderabad to Bombay, where they incur flights, travel, taxi, food, etc.

All those bills are scanned on the mobile app at real time by the employee. These bills are then sent through the platform to the approver. The approver can then go ahead and approve these bills on his or her mobile app. And post that entire cycle, finance then goes ahead and credits the reimbursement onto a Zaggle prepaid card. This happens when the employee has incurred these expenses on a personal credit card or personal payment instrument and the reimbursement is being credited in a Zaggle multi-wallet prepaid card.

The other model is the launch of corporate credit cards where the employee can go ahead and directly spend it through a corporate credit card issued by Zaggle and a partner bank. And in such a case, all the bills are scanned on the platform for records and the company goes ahead and clears the credit card bills.

ZAGGLE relies on its banking partners to issue co-branded cards which are issued to its customers. The company’s banking partnerships are with ICICI Bank, SBI Cards, Bank of Baroda, Kotak bank, IDFC First Bank, IndusInd Bank, Yes Bank, DBS Bank as well as NSDL Payments Bank. The company works with network partners like Visa, RuPay, and MasterCard.

Thus, the overall revenue via Propel is where you have redemption options, where you can redeem vouchers of brands or redeem points which could be credited on to a prepaid card. This is referred to as program fees i.e. the income that Zaggle earns based on the transactions that happen on the prepaid cards or credit cards. This is a combination of income that is earned through partner banks, through networks and any other smaller fees etc. that Zaggle levies.

The other stream of revenue is software fees which is the subscription fees for using the Save platform. Fees range between ₹100 - ₹250 per user per month. Contracts range between 3-5 years per corporate with some having auto-renewals. Some contracts however state that the company may charge only for those employees who are active and doing activity like uploading bills etc. on the platform.

Zoyer: An integrated platform to enable customers to use the Zaggle card with the software platform

i.e. How does a corporate client benefit from ZAGGLE’s products?

Zaggle has integrations with most major ERP providers like SAP and using this integration corporates are able to manage, and limit spending based on different types of expense heads. Say a corporate wants to limit overall travel costs to say, ₹5 crores. Now this they are able to ensure and enable through the spend analytics platform, because Zaggle is able to, on each card spent, link it to the limits and controls that they have set on the platform. A standalone card platform would not be able to understand what the project code is itself, because it doesn't have an API integration with the ERP. Zaggle is able to do so because the platform sits in the middle of the card management system, which is the system of transactions, and the system of records, which is the ERP.

In addition, admins are able to view pie charts, bar graphs, etc. a breakup of where the spends are happening across different spend categories, like saying where is the money being spent for travel and entertainment, client entertainment, how does it break up for different geographies, how do employees in Jaipur spend, how do employees in Bombay spend, filter fraudulent claims, avoid duplicate claims etc. Furthermore, Blinkit signed up for BROME which is a solution within Zoyer wherein corporates can manage their branch, store-level expenses with secure payments, compliance checks and real time insights.

All this is done through API integrations that the Co has, either with the bank/networks or both as well as with the ERP of the corporate. Network as in Visa, RuPay, MasterCard.

Here again the Co earns via software and transaction fees. That is the co earns a per user per month fee in software as well as per invoice fee for the platform and on the card, the interchange fee.

In addition to the above three platforms, Zaggle has entered into a few other ancillary segments such as:

Fleet Loyalty Program: Putting the money on the prepaid card and loading money on a periodic basis helps fleet owners manage their cash better. This is because sometimes the owners have to pay the drivers upfront for a trip which could be 30 days. Zaggle will give the fleet owners the prepaid cards and the fleet owners could pass it on to the drivers. The fleet owners would have a dashboard on which they can monitor how the spends are happening and can block/unblock the cards in real time. The revenue is earned via a combination of the program fees when the spend happens and an initial fee when the cards are issues to the fleet owners. Clients include Torrent gas and AGP City Gas.

Zaggle International Payments: aka ZIP, which focuses on forex and remittances. There are quite a few revenue pockets here: Interchange fees is much higher for forex. Other fees that can be charged to the user because there are ATM withdrawal fees, loading fees, card issuance fees etc. Also there's forex markup also that the bank or the issuer is able to earn because of the difference in the bank's rate of forex and what the customer gets.

BROME: This is essentially a petty cash management system which helps in payment of rents, utility bills etc. across many many branches. So any company with retail outlets, network offices or stores be it an NBFC, bank, restaurant chain, departmental store chain etc. with more 25-30 branches can avail this solution. In 2-3 years, the mgt expects this to be a substantial part of the business.

In Q2 FY25, the company acquired TaxSpanner which allows Zaggle to add comprehensive tax services. This co works with vendors of companies who require to file their TDS returns. Similarly, in the Propel platform, we work with agents, retailers, gig workers and dealers who need to file their tax returns. This is similar to a ClearTax like product.

Understanding the Financials

Here’s a snapshot from its Q3 FY25 presentation:

And here’s how you should link the revenue and their respective heads:

ZAGGLE derives revenue from its platform in the following 3 forms:

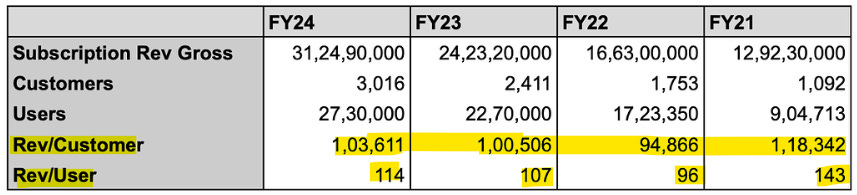

• Subscription fees: This is the software fees charged monthly/annually to corporates for using the platform. This is earned across all three products. Lowest of the three verticals. Subscription revenue on per customer (corporate/SME) basis is ~Rs 1 lakh. Subscription revenue on per employee basis is ~Rs 100.

• Program/interchange fees: Banking partners share a proportion of the interchange earned on spends done using ZAGGLE co-branded cards. This is earned across all three products. Significant amount of these fees are given back to the employee as cashbacks which was ~₹252 crores as of 9M FY25 (screenshot above). This is necessary as employees will always prefer to use their own personal cards if cashbacks are better and then take reimbursement from the company. Indians are very price sensitive and will not use these cards if their personal cards give better cashbacks. Fluctuations in % of cashbacks given will determine margins.

• Propel platform/gift card fees: Zaggle allows employees of corporations/SMEs to claim rewards as gift vouchers for food, shopping etc. This is analogous to your credit card’s rewards portal, except here the corporate/SME is buying these gift vouchers for employees as an incentive, bonus, to take advantage of tax exemptions etc.. This is earned only in Propel and recognized on gross basis. Since Zaggle goes out and buys this in bulk from the merchant (e.g. say Shopper’s Shop), they get a discount which is their revenue. This amount that Zaggle pays to merchants is listed as “Cost of point redemption/gift card” in thier P&L. (screenshot above)

Regarding working capital, SaaS fees are received in 50-60 days, same for the program fee which they receive from banks. Redemption for Propel points where corporates have to be given redemption upfront is 32-35 days.

The IPO & the QIP

Zaggle announced its IPO in Sept. 2023 to raise ₹392 crores via fresh issue and ₹171 crores via offer for sale by the promoters. The money was supposed to be used for customer acquisition and product development. As of Q2FY25 ~41% of the IPO proceeds were unutilised.

It also used a small part of the money to pay off debt which notably went down from ₹141 Cr in March’23 to ~₹56 Crs as of Sept’24. The rest for acquisitions like TaxSpanner.

In Dec 2024, the co raised a QIP of ₹595 crores for inorganic expansions in the spend management and adjacent space such as payment infrastructure, merchant card software, FastTag etc. In such spirit, in March’25 Zaggle acquired a ~45% stake in Effiasoft, a billing & POS software for sales, purchase, CRM, inventory, taxation & accounting across retail, restaurants etc. Also another ~38% odd stake in digital payment solutions company Mobileware Technologies.

All this is part of Zaggle’s acquisition-based strategy to pivot from a product to a full stack platform company.

A Framework to think about Zaggle

There are 4 levers of revenue growth for the company:

The number of corporates onboarded

The number of users that get added within the corporate.

The number of solutions that the company can provide.

The amount of spends which the users do on the cards.

Whereas the major cost drivers are the following:

Voucher costs where gross margins are about 6-10%

Cashback & Incentives to the tune of 65-70%

Product development and acquisitions

As per its concalls, the co’s focus has been to:

Cross sell product to existing users to generate more ARPU

Cull the amount of cashbacks and increntives given

Overall transition from Zaggle as a Product to a Platform

So let’s take it from the top.

The no. of users on the platform had increased at a high pace during the past couple of years. The same is expected to increase during the next couple of years as existing corporates become more mature and engagement with recently onboarded corporates go live. The number and quality of customers give a strong indication that the co’s products has a definite use case.

Zaggle’s ongoing transition from a product to a platform company is clear to see. From core products like Propel and Save to inhouse developments like Zatix, ZIP, fleet management etc. All this combined with a host of acquisitions from the IPO and QIP proceeds as people have mentioned in earlier threads. As of Q3 FY25, the co also launched in-app products across health and wellness wallet, cafeteria solutions, employee gadget solution etc.

There are a lot of expense management SaaS apps for expenses management, fleet management, vendor management, educational institution management etc. What Zaggle is trying to do is consolidate them under one platform; kind of like a super-app.

All this is aimed at integrating Zaggle’s services across various touchpoints of a corporate’s expense heads. Thus subsequently increasing customer stickiness and cross-selling new solutions to existing clients to increase the ARPU.

An increase in revenue can come from increase in subscription fees which has been ~₹110 per year per user for the past two years. The company is pivoting to offer bundled solutions to companies so as to lock in higher fees. For example, giving Zepto both Save and Zoyer during sign-up. However, this is unlikely to lead to non-linear increase in subscription fees which is presently ~4% of revenue but flows down to P&L as pure profits. ~₹110 per year per user is low and maybe the present strategy is to give away the software for free in the hopes of capturing revenues from interchange fees and gift vouchers redemptions.

Another way of increase in profits is via higher program fees but this is dependent on employee spends; which in turn is dependent on how much cashbacks and incentives is given to users so that they spend via Zaggle credit cards and not via their personal ones. There is little operating leverage at play here and revenues and costs will increase almost hand in hand.

The blended interchange fee for the past 4 quarters was 1.71%. We expect this to come down in the following quarters. Why? Because this interchange %age varies across products. E-commerce has the highest margin at ~2.2% whereas groceries and fuel are lower. Hence increasing spends on lower fees items can push the margins further down. And given the recurrent nature of fuel (in fleet management segment) and grocery spends, it is likely that the contribution of these lower fees items will be higher.

All that said, program fees segment is expected to be the fastest growing in the next couple of years.

Currently the company enjoys EBITDA margins of 9-10% which is expected to increase to 11% in FY26. The primary reason for this is an increasing share of propel point/voucher in the total mix. The EBITDA margins in the Propel segment is 6-10% which is much lower than the interchange fees and thus brings the overall blended margins down. However, the Propel/ voucher program has a slab structure where post a certain threshold being reached in terms of sales of vouchers, merchants give better margins to the Co. This is only going to make an incremental impact though.

The challenge with the business is not in revenue growth but realizing whether it can realize higher margins and PAT in the next 3 years. At the current valuations of 64x PE, growth is well priced in.

The case for margins

‘Incentives & Cashbacks’ comprise of 28-30% of the annual expenses. Reduction under this head is the only substantial way margins can be increased. But there is unlikely to be a sudden drop in the same due to the people switching from Zaggle to their personal cards as explained above.

Valuations - Stretched but only a bit

1️⃣Management guides for a 63% revenue growth for FY25 which amounts to ~₹1265 crs for the full year. Assumming a TTM PAT margin of 6.5%, that would amount to FY5 PAT of ~₹82 crs. If we take a high 40% PAT growth in FY26 and FY27 that would impute forward PEs of 40x and 29x at the current market cap of ~₹4600 crs.

The keywords in the above are a) 40% revenue growth rate b) margins remaining constant (although mgt guided for a 1 - 1.5% increase in EBITDA margins)

2️⃣Equirus performed a DCF this time around last year, with the below assumption and came up with est. market cap of ~5400 crs as of FY26. The important thing to notice here is the revenue assumtions made to arrive at the valuations. ~19% growth rate from FY27E -FY34E plus a terminal growth rate of 5% seems a bit aggressive.

3️⃣Zaggle presently operates at a TTM price-to-sales of ~4.1x which is seems to be close but less than comparable companies. Such companies include IT companies with a sub-₹10,000 crore market cap with a sales growth of 30% or more over the last 3 years.

Final Thoughts

Overall, Zaggle is a high growth company with many levers of growth. There product has found high acceptance as witnessed by the quality of onboarded customers. With the large base of customers, the long-term goal for the Co would be to further monetize this existing base of customer by cross-selling more products in the platform. As such, new product development and acquisitions would play a key part. Also, we’ll have to keep an eye as to how margins evolve in the coming years.

Speaking risks: slowdown in customer acquisition/spends, incentives and cashbacks as a high proportion of program fees, regualtory changes impacting interchange revenues are apparent business risks. However, other less optical risks include frequent rounds of equity dilution and lower interchange margins owing to greater mix of high-frequency-low-margin spends.

We didn’t touch on competition here as the company has no direct competitors. There are a few players who provide some standalone solutions but are not close to the scale of Zaggle. Remote, Fyle & Happay are some of the comparable solutions.

Given the current valuations, and the upcoming round of market corrections next week, we believe the Co would trade at an attractive zone. We hold a tracking position in the stock and would average more in the next few weeks.

Disclaimer: These are my views on Zaggle Prepaid Ocean Services Ltd. This is NOT an investment advice, just perspective. My opinions might change anytime and I would not be obliged to update the same here. So please do your own research before making a buy/sell decison.

Special mentions as sources:

Equirius Securities’ Zaggle Initiating Coverage Note

vada_buffet‘s thread on ValuePickr

Hi. Glad you liked it. To answer your queries:

1. CFO for FY24 was negative due to high trade receivables from banks & corporates and also due to loading of prepaid cards for redeeming vouchers via Propel. The same was moderate as of H2 FY25, due to the above being offset by customer advances. The credit card-like (such as SBI cards) nature of the business is such that the receivables will be high (thus consequently -ve CFO) given the company's revenue growth rates. We find comfort from the fact that the company is able to support this working capital with minimal external borrowing.

2. Regarding NPM, the bet seem to be that the company can generate higher ARPU by cross-selling other products in their platform to existing customers and also by partially moderating thier cashback & incentives as % of revenue.

Hope this helps.

One of the best thesis I have seen in a few days. Btw-

1) Cashflow is in negative- The company seems to be running on cash from debt and shares.Such cash may be a tad expensive.Why receivables are so high?

2)Net Profit margin seems low about 5.6%….

These are my only concerns. Is cashflow like this because of its NBFC-like nature?Also while giving out the prepaid cards do they asses/profile the borrower?