Kiri Industries: ₹3500 Cr mcap Co awaiting a ₹5000 crore payment

Issue #8 analyzes Kiri Industries' decade long litigation and why recent events reveal a turning point that the case will finally reach a resolution.

Kiri Industries is engaged in manufacturing and selling Dyes, Dyes Intermediates and Basic Chemicals. These reactive dyes, called synthetic organic dyes are used for cotton fabrics like garments, dress materials, bedsheets, carpets etc. All the products manufactured by the company have comes under two groups, such as Reactive Dyes and Intermediate Dyes have found global acceptance.

The product range of the company comprises of more than 120 dyestuffs used by textiles, leather, paint and printing ink industries produced across 5 manufacturing units in Gujrat.

However, Kiri’s business has been struggling. The business has been plagued by losses and continues to face challenges, such as weak demand, underutilized capacities, and rising raw material & power costs.

However, the investment thesis is not related to Kiri's current business. Instead, it is based on the ongoing legal battle between Kiri and Longsheng over their JV’s subsidiary company DyStar. A decade long litigation is nearing conclusion owing to which Kiri Industries stands to gain windfall profits of ~₹5000 crs.

Executive Summary

In 2010, Kiri Industries via a JV with China’s Senda International Ltd’s subsidiary Longsheng acquired assets of Dystar. Kiri has a 37.57% stake in the company.

In 2015, Kiri Filed minority oppression suit against Senda and DyStar in Singapore International Commercial Court (SICC).

Kiri claimed that Longsheng engaged in activities that were not in DyStar's and the minority shareholder’s best interests, such as related-party transactions, misuse of patents, unfair suppression of dividends, and unauthorized payments to directors.

In 2024 after almost a decade long legal tussel, SICC ordered an En Bloc sale of DyStar through the court appointed receiver and award priority payment of US$ 603.80 Mn to the company.

Further in 2024 Deloitte & Touche LLP, Singapore wass appointed to oversee the process.

Recently in 2025, the Supreme Court of Singapore awarded Interest of 5.33% on USD 603.80 Mn from September 2023 till payment (USD 70mn roughly). Also reimbursement of legal fees to the tune of USD 10mn.

Now that we have an overview of the case, let’s delve into the details.

History & Structure of the Deal

DyStar was created by Bayer and Hoechst in 1995. In 2000, the Co was boosted by integration of BASF's textile-dye business. Post which the Co was owned by BASF, Bayer and Hoechst in 30:35:35 proportion.

As of 2003, DyStar was the world’s largest textile dyes maker, with sales of about $960 million and 3,900 employees and with operations across more than 20 countries in Europe, Asia, Africa and the Americas

In August 2004, it was acquired by a Los Angeles-based private equity firm Platinum Equity for roughly $680 million against 100% shares of the company.

After failed attempts to address liquidity pressures, the company filed for bankruptcy in Sept. 2009 (just after the 2008 GFC which tightened credit markets globally).

In early 2008, Ahmedabad-based dyes and derivative products manufacturer, Kiri Dyes and Chemicals Ltd. had raised nearly Rs 56 crore through an IPO to fund its backward integration to produce inputs for dye intermediates.

In February 2010, the company along with Longshen (subsidiary of Senda) acquired acquired assets of DyStar Textilfarben GmbH and DyStar Textilfarben GmbH & Co. Deutschland KG (DyStar) along with its 36 subsidiaries after it emerged from bankruptcy. Thereafter, in October 2010, KHSPL acquired DyStar LP USA for USD 10 Million.

The entire acquisition was carried out through Kiri Dye's wholly owned subsidiary Kiri Holding Singapore. The holding company issued zero coupon convertible bonds to Lonsen to raise funds. Post conversion of these bonds, Kiri Dyes will hold 37.57% in DyStar.

Kiri Dyes paid 50 million euro for Germany's DyStar Group. Kiri Holding Singapore Pvt Ltd, a joint venture between Kiri Dyes and China-based Longsheng Group, raised about 100 million euro to fund the acquisition. The company raised 65 million euros from debt and 35 million euros of FCCBs.

Kiri Dyes and Chemicals Ltd lined up a 2-year-long business re-structuring plan for DyStar Group. The plan was to restructure and turn around the then debt-ridden company, by closing down its plants in developed countries and shifting of production lines to low- cost locations such as India, China and other Asian countries.

The acquisition, right from the beginning, appeared to be a promising one as it gave access to DyStar’s 16 manufacturing plants with a combined production capacity of 176,000 TPA (at that time), apart from its brand, patents, technical know-how and most importantly around 21% global market share (at that time).

In 2011, the company changed its name from Kiri Dyes And Chemicals Ltd. to Kiri Industries Ltd.

As of year-end 2014, DyStar had consolidated revenues of over a billion dollars and profits to the tune of ~$100 million.

In June 2015, it made a corporate announcement stating legal proceedings in the High Court of Singapore against Longsheng to enforce its rights as a significant minority shareholder, arising from matters including governance and intellectual property rights of DyStar, and unlocking value of the Company’s shares in DyStar.

A point of note is that had someone looked at Kiri’s Consolidated Balance Sheet as at 31-03-15, he would have a good reason to feel upset as the debt levels had shot up to 791 crores (735 crores of long-term borrowing + 52 crores of short-term borrowing).

However, on April 5, 2016 it filed an announcement related to the closure of plant by the Chinese giant Hubei Chuyuan, the largest dye intermediate manufacture in the world at that time ( 30 percent of the global consumption). This was during the time when the Chinese government asked most of the polluting plants to move from the east side (the east was heavily populated hence posed a danger to human life) to the west side. This led to a dramatic surge in prices of Dyes intermediates as outlined below. This led the company to significantly reduce its borrowings.

The above was the history of Kiri Industries and Dystar. Now let’s look at the historical summary of the litigation to understand why it took almost a decade to sort it out.

Summary of the Litigation

The details of the case till 2023 has been very well summarized by Abhinav Kukreja. Although, we have skimmed through the details of the case, we couldn’t have done better justice (yeah pun intended) to it. Given below is the summary from

. If you want to geek out on SICC’s actual judgements, you may find it here.January 2018 - After 3 long years, recording of all evidence is finally completed.

July 2018 - Main Judgement by the Singapore International Commercial Court (SICC) - Senda to Buy Out Kiri’s Stake in DyStar

August 2018 - Appeal by Senda in the Court of Appeal (AKA Supreme Court of Singapore), plus a Stay Application filed in SICC

August 2018 - Stay granted on purchase of shares, but not on the valuation process

September 2018 - Valuation process started by the SICC

January 2019 - SICC Judgement says no minority discount (DLOM) to be applied.

May 2019 - Court of Appeal rejects Senda’s appeal against the July 2018 order

October 2019 - Senda appeals the January 2019 valuation discount judgement in the Court of Appeal

February 2020 - Court of Appeal rejects Senda’s valuation discount appeal

December 2020 - Interim order issued by the SICC ascribing a valuation of $1630m to DyStar

January 2021 - Appeals filed by both Kiri and Senda in the Court of Appeal against the SICC valuation June 2021 - Valuation Set by SICC for Kiri’s Stake - US$481.60 M (₹4000 Cr), assuming a 19% minority discount.

December 2021 - SICC delivers judgment on minority oppression lawsuit and orders Senda to pay Kiri S$8m (₹50Cr) by January 2023.

March 2023 - SICC issues order for final valuation - $603.8m (₹4800 Cr) or a 25% increase from the earlier valuation - minority discount is removed.

In 2024, SICC Order En Bloc sale of DyStar through the court appointed receiver and award priority payment of US$ 603.80 Mn to the company.

Further in 2024 Deloitte & Touche LLP, Singapore was appointed to oversee the process.

In 2025, Supreme Court of Singapore awarded Interest of 5.33% on USD 603.80 Mn from September 2023 till payment. (USD 70mn roughly) Also legal fees would be reimbursed to the tune of USD 10 Mn; Combining all of them for a total payout of USD 683.8 Mn

Now that we have all the details out of the way, let’s understand the nuances of the thesis. However, we urge you to skim through the above summaries once more to solidify the understanding of the case.

And if you like our writing please take a second to subscribe.

In Kiri Industries, the bet is on the receipt of the money - in full and within the stipulated timeframe. We are not interested and unlikely to be vested in the future of the business.

Once the Dystar money is received, we are likely to exit the investment.

All that said, there are 2 variables to this bet:

1. The sale – At what valuation would DyStar be sold at?

2. Timeline – How quickly will the cash be realized on the transaction?

At what valuation would DyStar be sold at?

Another way to ask the question is whether the sales price is enough to pay Kiri the $684 Mn.

Kiri Industries Ltd will realize a combined total of $684 Mn: ~$604 Mn via its stake sale of DyStar and the rest ~$80 Mn as interest + legal fees from Longsheng. To realize the stake sale proceeds, the company has to be sold for at least the same amount. Kiri has been awarded priority [FD1] payment and hence even if the company sells for $610 Mn, the first $604 Mn will go to Kiri Industries and the rest $6 Mn to Longsheng.

In its Q3 FY25 concall dated Feb’19 2025, management mentioned the sell process of DyStar is in the final phase and there are almost 5 select bidders who are going through a second and the final stage of due diligence. Also, legally binding offer with proof and commitments of funds were expected to be filed by March 7, but no such things have surfaced as of date.

The first question to answer is how much is the DyStar group worth?

In its consolidated financial statements, Kiri along with its other subsidiaries also combines the proportionate share of Dystar. However, these are only bookkeeping entries to comply with standards and there is NO actual exchange of cash flow. Dystar’s financials are not publicly available and given it is not straightforward to compute subsidiary’s balance sheet items from consolidated statements, we’ll stick to a simple PE multiple method for valuation.

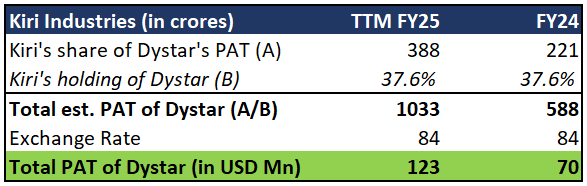

Kiri’s share of DyStar Group’s PAT for:

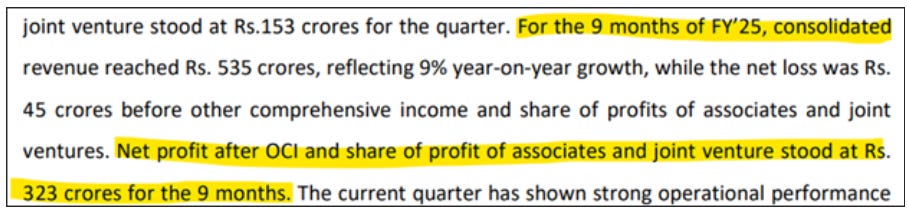

9M FY25 PAT was 290 Crs (less 10% to account for contribution from other subsidiaries):

FY24 PAT was 221 Crs:

From the given extracts we compute the total PAT of DyStar as:

The most recent comparable transactions globally has been Heubach Group, in partnership with SK Capital, had acquired acquire Clariant’s pigments business for Price/Sales multiple of 1.2x in 2022.

The second is Sun Chemical’s acquisition of BASF’s global pigment business at an estimated Price/EBITDA multiple of 9.5x and Price/Sales of 1.15x in 2021.

Given both the deals happened at a similar time, their Price/Sales multiple are similar. Given a 9.5x Price/EBITDA multiple for the second deal, it is reasonable to assume a 12x PE (PE multiple will be higher compared to P/EBITDA) in 2025 for DyStar. This imputes a conservative valuation of ~$850 Mn.

In Q3 FY25, management was asked regarding the valuation of DyStar to which they stated that they expect the bid to come between $1.3 to $1.9 billion.

Unless a formal bid/s are made, we can’t be sure of the valuations. Although, we believe the $1.9 Bn valuation is quite bloated.

$683.8 Mn at an exchange rate of INR 85.3/USD amounts to ~5833 Crs. However, this is not the amount that the company would receive. You guessed it right – Tax!

Total estimated payout, post-tax is expected to be ~5074 crores as neatly estimated by

.

What does Kiri plan to do with the money?

Kiri Industries aims to invest Rs 8,000 crore in two phases to set up a facility with a 0.5 MTPA facility to produce copper products like rods, coils, tubes and cathodes. The total investment will be 8000Cr, funded with a 2:1 debt-to-equity ratio in two phases.

As production increases, the company expects to generate revenues of close to 16k Cr from the first phase and 40-50k Cr from this new venture after the second phase over the next 3-4 years. (FY24 topline - 950 Cr). Although, we are not interested in the future business operations of the company, this article here provides a reality check for its lofty targets, especially for a company with no prior experience in the sector.

Given a 2:1 debt to equity split, the Co would use half of the proceeds (~2500 crs) as an infusion for its copper business and the rest would remain with the company and then the board will decide what to do with that.

How quickly will the cash be realized on the transaction?

A better way to approach the matter is to ask how likely it is that DyStar will be sold soon?

While there have been several instances in the past where it seemed like the DyStar case was about to conclude, there are two key developments this time that provide strong confidence the case will finally reach a resolution:

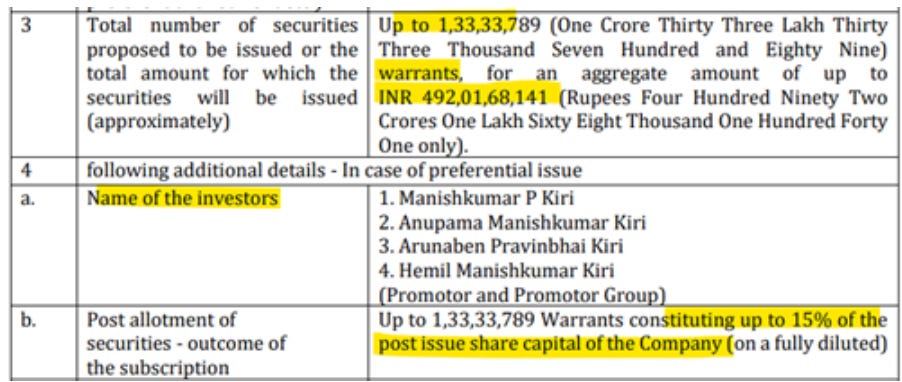

First, the promoters of Kiri Industries applied for warrants worth ₹492 Cr in October, which, when converted over the next 18 months, will increase their shareholding from the current 26.7% to 41.7%.

Out of which the company paid ₹250 Cr in Oct’24:

and an additional ₹68.6 Cr in Nov’24:

All of these events took place within 3 months b/w Aug to Nov’24. The important thing to notice about this deal is that only promoters participated in this preferential issue. No preferential issue for outsiders, no rights issue. In 2021, the shareholding of promoters decreased due to conversion of FCCBs which they used to finance the litigation.

As such, the promoters haven’t bought any shares in the company since 2018 till now. Suddenly after 7 years, the promoters have come and infused ~320 Crs in the business via the warrants. As of April 16th, a little over 28% of warrants have been converted. The promoters stand to lose the remainder of warrant issue amount (~180 crores) if the rest of the warrants are not converted within 18 months from the issue date of Oct’24; which we are reasonably certain are very much against their interests.

Second, in Sep’24 Kiri Industries via their Singapore entity took a $130 million loan. This money was raised as an advance against the SICC judgement so that they could kickstart the capex for their copper project without waiting for the DyStar sale cash. This loan was given after legal due diligence by a private credit fund and with the expectation/confidence that it will be repaid once the DyStar sale is completed next year.

Both these actions by the management show confidence that the transaction will finally close successfully this time, and Kiri will receive the ₹5000 Cr payout it has been waiting for over a decade.

The Risks

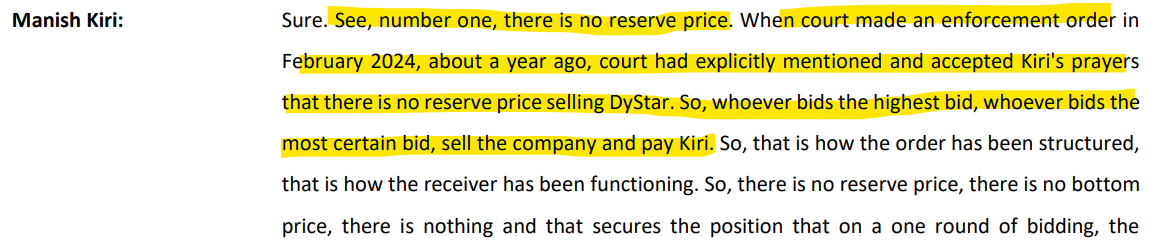

Sale Price - The elephant in the room is that there has been no known official/formal bid from any prospective buyers. In 2024, Deloitte & Touche LLP was appointed to invite bids and oversee the auction process with expected completion by Dec 2025. But no new updates regarding any strong interests or bids have been notified. Also there isn’t any reserve/floor price which creates further uncertainty in the final sale amount.

Also, given prospective buyers would know there is some desperation to sell Dystar along with global certainty owing to tariffs and all, the final sale amount may be settled at a significant discount. Also, given the size of the acquisition, it may be a cash and stock deal rather than an all-cash deal which may complicate the payout.

Timeliness - Given the judgement from SICC is in full favor of Kiri, there is little that Longsheng can do to overturn the same. The main risk as of now is that receipt of the proceeds being delayed beyond the end of 2025 for regulatory reasons such as acceptance of a formal bid and due diligence by Deloitte. Then there are approvals required from shareholders and creditors of DyStar. Followed by possible regulatory approvals from the Competition Commission of India, SEBI and FEMA (due to exchange of foreign currency). Also, correspondence of all these will involve jurisdiction of multiple countries – India, China & Singapore. All this can can lead to a drag on the time to receive the money.

Then there is a tail risk that Longsheng chooses to litigate further. Chances are low but we have seen it happen before.

Final Thoughts

Majority of Kiri’s ~₹3500 crs market cap comes from the anticpation of the Dystar proceeds. Assuming a conservative price-to-book of ~1x, Kiri Industries’ worth (ex - Dystar proceeds) would be ~400 Crs. As such, we may expect the following upside from the stock on a fully dilutive basis (i.e. given that promoter exercises all the warrants) and the sale price works out.

Since Nov’24, after the promoters exercised the warrant the stock has doubled from ₹350 to ₹650 in anticipation of a quick resolution. The enthusiasm persisted in January’25 when SICC awarded the interest and legal fees payment of USD 83.8 Mn. In the last 3-4 months however, the stock seem to be consolidating b/w ₹530 - ₹650. This consolidation is due to the absence of any formal bids.

We believe that the if the stock price where to appreciate, it would in a staggered approach. Bid start to come in > buyer is finalized and price gets fixed > Important regulatory approvals are in place. However, the markets discounts the future and thus the impact of the proceeds would be fully priced in before the actual money is received.

At present, we have allocated a small (~3%) portion of our portfolio in this. To iterate, the bet is on the receipt of the money and we are likely to exit the investment once the likelihood of the same is entirely established. In between expect volatility if the bids are lower than expected or Longsheng comes up with new antics. We are actively tracking the matter and would likely add a little more our holdings if and when we see the matter moving to a favorable direction.

Disclaimer: These are our views on the Kiri Industries Ltd. This is NOT an investment advice, just perspective. Our opinions might change anytime and we would not be obliged to update the same here. So please do your own research before making a buy/sell decison.

The business has been making losses over the past few years and China would continue to dump

6.5crore shares post preferential shares issue, ~5000cr payout results in ~770 per share and the same is planned to be invested in greenfield projects (in addition to taking in a large amount of debt) where they seem to have no expertise.

Sounds like a risky bet.

Beautifully summed up ! Just a doubt. FY 25 PAT is 265 Crs. At a P/E of 5 , the market cap comes at around 1325 Crs. On what basis did you value Kiri's existing business at 400 Crs?