Beyond Salaries & RPT: A Micro Cap Investor's Ultimate Checklist for Corp. Governance

Issue #15 provides a practical checklist to assess a Co's governance quality, by breaking down its Auditors, Board, Promoters & Employees.

The checklist that follows was refined across 4 years, from scores of Co’s annual reports. It accounts for nuances of different boards structures, varied forms of promoter remuneration, auditor responsibilities etc., with careful weightage for each category. This is something which we maintained as proprietary till date.

Then we thought what the heck. All good things must come to an end be shared.

Imagine two companies with similar growth prospects, robust balance sheets, and compelling market stories. Yet, over a decade, one outpaces the other by a wide margin, weathering crisis from time to time while quickly seizing opportunities. What sets them apart? More often than not, the answer lies not in their financials, but in the not so visible scaffolding of governance quality.

For serious investors, governance is no longer a theoretical concern — it is the bedrock upon which sustainable value is built. The crumbling of fast growing or blue-chip names like Byju’s, Gensol, Satyam, BluSmart, Yes Bank, IndusInd, DHFL, Manpasand Beverages, Amtek Auto, DHFL, PNB offers sobering reminders: Weak Governance is not an Abstract Risk, but a Catalyst for Catastrophic Losses.

A recent MSCI study found that companies in the top governance quintile outperformed those in the bottom quintile by an average of 15% over a five-year period. In another CFA Institute survey, over 60% of institutional investors admitted that assessing governance was the single most challenging aspect of their investment process.

Yet, despite its outsized importance, practical guidance for assessing governance quality remains frustratingly sparse. Investors are fed ESG ratings, policy statements, and proxy voting recommendations, which rarely capture the nuanced realities that separate effective oversight from mere box-ticking. How, for example, does one measure the true independence of a board? Or distinguish between a robust risk culture and one that simply pays lip service to compliance?

The problems are ever so magnified when it comes to retail investors with limited resources. Even the most seasoned professionals often find themselves relying on heuristics rather than insight.

This checklist and accompanying guide aims to change that. By grounding assessment in practical, actionable criteria — drawn from assessing dozens of companies for years – this is an effort to bridge the gap between theory and practice. Whether it’s evaluating board composition, scrutinizing incentive structures, or probing the integrity of audit processes, we hope our approach empowers investors to move beyond superficial signals to deep drivers of governance quality.

Read on — What follows may be the most important piece you may have read in a while.

We have divided governance checks into four aspects with the following weightage:

1. Auditors (20%)

2. Board of Directors (30%)

3. Promoters (35%)

4. Employee Sentiments & CSR (15%)

Auditors (20%):

1. Growth in Auditor remuneration to growth in revenues

2. Track record of auditors in auditing other Cos – whether the auditor works with reputed Cos, has worked with dis-reputed Cos in the past, any link with scams/ frauds in the past

3. Whether any frequent changes in Auditors in the past 10 years

4. Key Audit Matters and Modified Opinions in the past 10 years

5. Revenue & PAT contributions from unaudited subsidiaries. Ratio of revenues/PAT from Audited (by auditors) to fully consolidated (including subsidiaries audited by other firms).

6. Wording of auditors in the beginning of audit report. Whether they are denying responsibility and putting entire onus of details on management.

7. LinkedIn profile to check credentials and experience of signing CA

Board of Directors - BoDs (30%):

1. Ratio of Independent directors to non-independent directors. Minimum 50% is a fair board.

2. Check how many other boards do these members sit in – directorship in many companies show seat warming ideology. Also whether other directorships are in reputed Cos.

3. Whether BoDs have relevant/ related experience to assess what happens in that business – for example a retired marine engineer sitting in the board of a bank hardly delivers any value

4. Whether BoDs are family, friends or distant relatives – This is hard to determine but can be identified by proxy checks such as whether these guys hail from same city/ district and whether they are all from the same community. Diverse representatives on the Board are always preferred after adjusting for irrelevance.

5. LinkedIn profile of BoDs to check their overall experience

6. No. of meetings held vs. attended, remuneration/ sitting fees in line with similar sized/ sector Cos

7. Tenor of these directors. Frequent change / repeated dismissal before finishing tenor demands caution/suspicion.

8. Whether CEO and Chairperson are different – brownie point

Promoters (35%):

The classic promoter salary as a % of PAT. Growth in promoter salary to growth in PAT across the years.

Component of promoter salary – whether he finances his entire lifestyle indirectly via the Company. Paying for vacation, rent, cars etc.

Growth in Related Party Transactions (RPT) over the year. Dissecting different line items in RPT to check for the same

Promoter buying/selling pattern in the past 10 years

Pledge Pattern and frequency of capital dilution

Google search to check for promoter frauds, litigation, scam

Frequency of change in KMPs/ Senior Management

Convoluted holding structures

Employee Sentiments (15%):

1. Check Glassdoor & Ambition Box for employee reviews – focus on the worst reviews and comments related to senior management.

One investor shared a telling tactic: the first stop on any factory tour isn’t the boardroom—it’s the workers’ washroom. Why? Because how a company treats its lowest-paid employees speaks volumes about its management’s integrity.

2. Employee retention rate, retirement and insurance benefits under Business Principle 3 – essential indicators

Note: Some analysts would also include details of CSR activities as proxy for governance checks. Measures such as whether CSR funds continually remain unspent / the promoter is putting the funds under his/her own NGO.

However, we believe including CSR checks in Corporate Governance analysis can muddy the waters by confusing true ethical oversight with philanthropic endeavors. Our opinion is, CSR most often reflects a company's public relations or brand image strategy rather than the integrity of a Co’s financial or operational controls. Hence, the exclusion from our checklist.

Now let’s run this checklist on Tips Music Ltd., a portfolio Co we held before we started the blog:

Auditor Checks: Here we check for the quality of the audit as well as the auditors

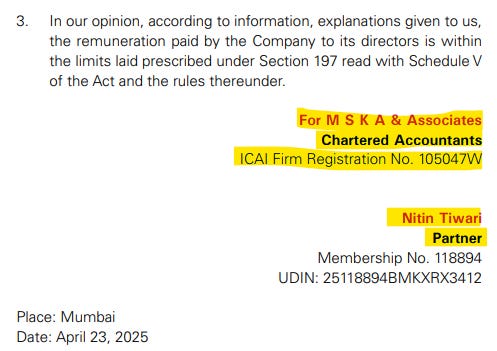

1. MSKA & Associates are the newly appointed auditors for the company starting FY25, with Nitin Tiwari being the partner.

Prior to FY25, for the past 10 years, SSPA & Associates were the auditors for the company. Even before that the auditors for Tips was M/s. B.K. Khare & Co.

As per the Companies Act, 2013,

For listed Cos, an individual auditor can be appointed for a maximum of one term of five consecutive years, while an audit firm can be appointed for a maximum of two terms of five consecutive years each.

As SSPA (the erstwhile audit firm) had served since FY15 for two terms of five consecutive years, Tips was required to appoint a new auditor which it did via MSKA.

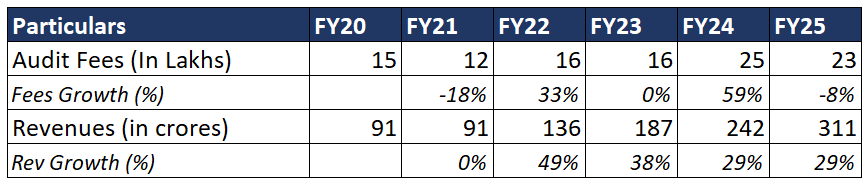

2. Auditor Remuneration vs Revenue Growth: Seems in line, nothing untoward. The remuneration includes the entire gamut of auditor expenses including reimbursement of expenses and professional fees for other legal services as detailed in the Other Expenses parts in the notes to accounts of ARs.

3. Since MSKA is the newly appointed auditor, we also need to include the past auditors for all of the subsequent checks. We ran a google search for SSPA & Associates and Parag Ved (partner) along with keywords such as ‘Spam’, ‘Fraud’ & ‘Litigation’. We did not find any record of misconduct.

Upon running a similar google search for MSKA we also found a clean chit. Except that MSKA & Associates (website), a member of BDO — a global audit and accounting firm based in Belgium, resigned as the auditors of the Ed tech startup, Byju’s. This is not a red flag as this auditor resigned within a year after after previous auditor, Deloitte’s exit.

4. Here are the brief details of the partners: sspa.in/resource/Partners.aspx along with the erstwhile signing partner’s (Parag’s) LinkedIn profile.

And here are the details of Nitin Tiwari, partner of Tip’s present audit firm MSKA.

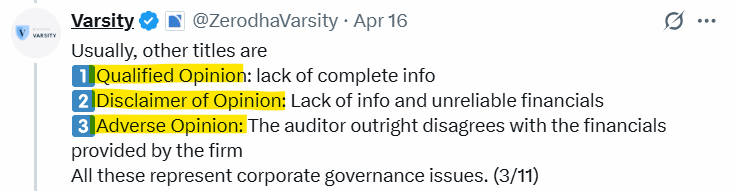

5. The Standards of Auditing (SA) establishes three types of modified opinion: Qualified Opinion, Adverse Opinion and a Disclaimer of Opinion. Here’s a long version and here is a shorter one:

There were no modified opinions issued by the auditors and neither were any key audit matters stated by the auditors.

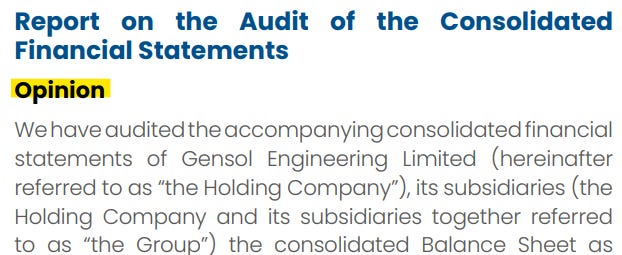

However, let’s check for a Co that surely would have had an Adverse Opinion in its recent Annual Reports - Gensol Engineering Ltd. If you thought yes, you are wrong. If you look at the Co’s FY24 AR you would not find any unusual Opinion from the auditor.

The first section of the Auditor's Report is titled “Opinion” or “Unqualified Opinion.” It is a red flag if titled anything else. A company with Opinion or Unqualified Opinion is not necessarily clean in its corporate governance. It only means that the auditor has not found any issue with the financials. Gensol’s financials seem clear. Corporate governance runs beyond just financials.

This is a sobering reminder given by Zerodha Varsity’s post on X. Check it out here.

However, the opposite is also true. If a Co’s auditor's eeport is titled Qualified Opinion does not necessarily make it fraudulent. For example, SAMHI Hotels, a newsletter Co, had a qualified report in its FY24 AR.

However, the basis for the qualified opinion was that their Information Technology (IT) Application Controls over the Opera and Oasis application software were not operating effectively as at 31 March 2024.

This is not good but not beyond unacceptable given the scale of the Co’s operations.

6. Revenue & PAT contributions from unaudited subsidiaries is a key monitorable. Tips Music only reports standalone financials as it does not have any associates, subsidiaries or joint ventures. Hence, we again take the example of SAMHI Hotels, which has many subsidiaries.

Compared to FY24 consolidated revenues, the % of revenues & total assets of the two subsidiaries which was not audited by the promoter was less than ~0.5% & 1.5% of the consolidated revenue and assets. Hence, the contribution of the these are immaterial.

We have already covered the partner profiles in Point 4 ☝🏻.

BoD Checks: Here we check for the Independence and Capability of the Board

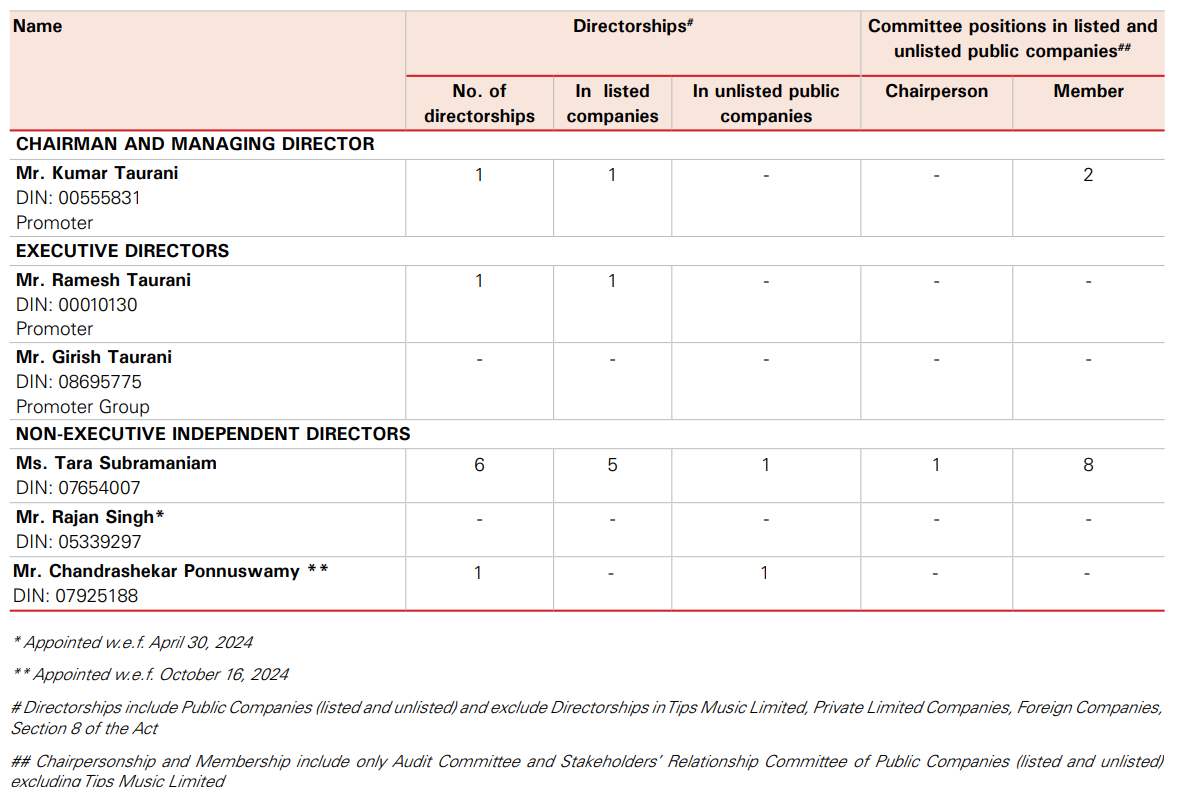

Till date 3 out of 6 were Independent Directors which satisfies the 50% thumb rule. Mr. Kumar Taurani and Mr. Ramesh Taurani are related to each other as brothers and Mr. Girish Taurani is son of Mr. Kumar Taurani. None of the other directors are related to each other.

Note: Mr. Shashikant Vyas resigned from the post of Independent Director due to pre-occupation.

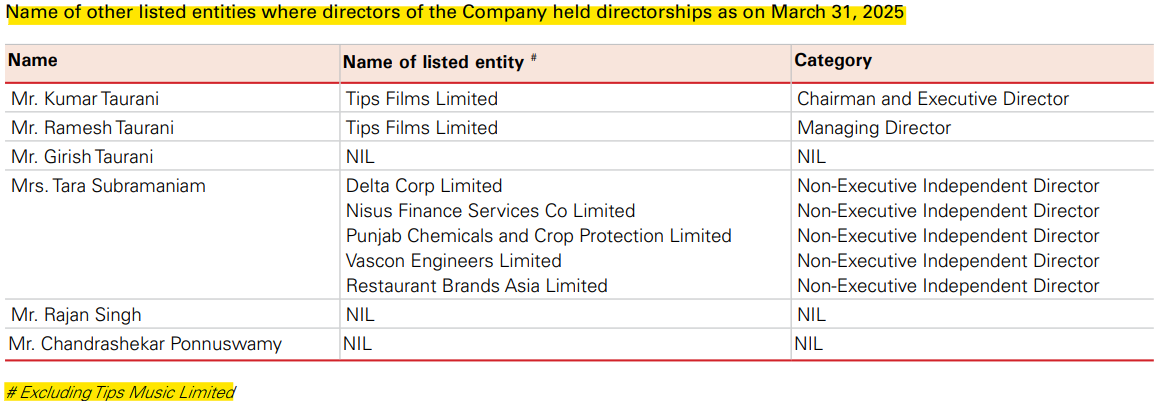

None of the Directors on the Board serve as Director or Independent Director in more than 7 other listed companies. Ms. Subramaniam is the only director who sits on the board of more than 5 companies. We presume this divides her attention and would naturally compel her to divide her time amongst her other Cos.

Following are the name of the listed entities in which they are vested in:

Even still, given Ms. Subramaniam holds directorships in reputed names such as Delta Corp and Restaurant Brands Asia (Burger King India) is a testimonial to her reputation.

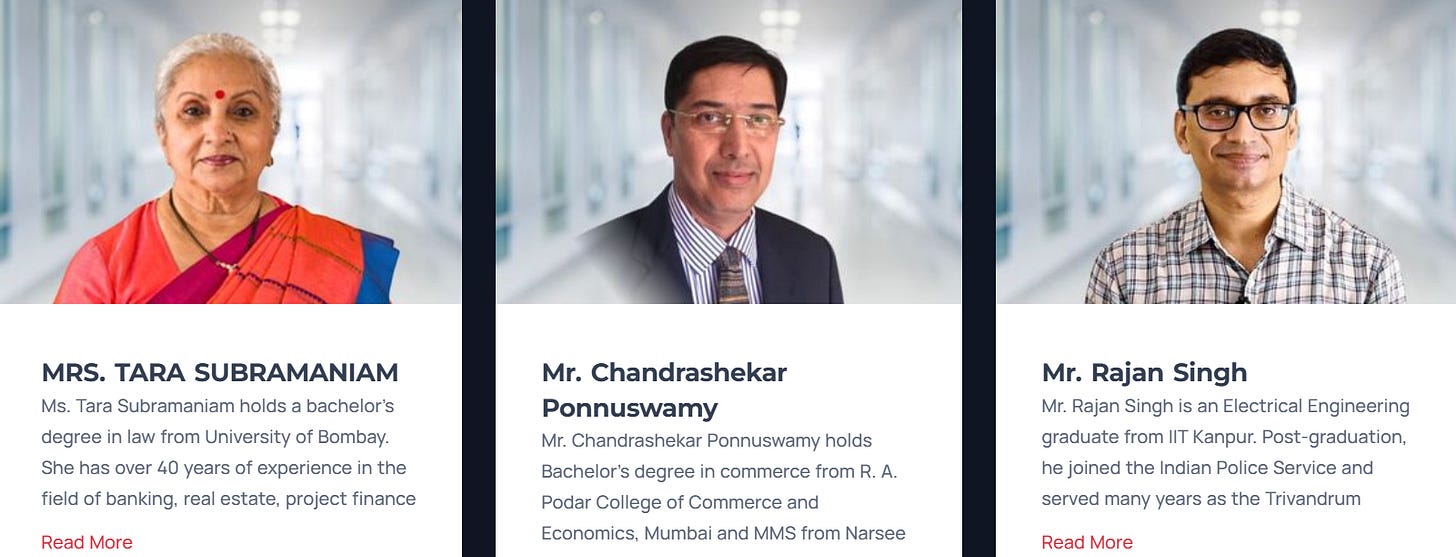

Based on our reading, all the BoDs have relevant and long years of experience, as can be seen in the About Section here. In fact, one of the positive triggers for our buying into TIPs was directorship of Mr. Rajan Singh. Mr Singh is an IIT Kanpur graduate turned IPS officer who later went for a Wharton MBA and went on to work in McKinsey and later in Private Equity.

4. None of the independent directors are related to the Taurani family.

5. The following are the profile of the Independent Directors. Rajan Singh, Mr. Chandrashekar Ponnuswamy

LinkedIn profile for Ms. Tara Subramaniam could not be found.

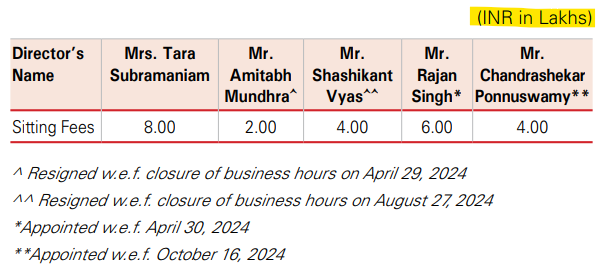

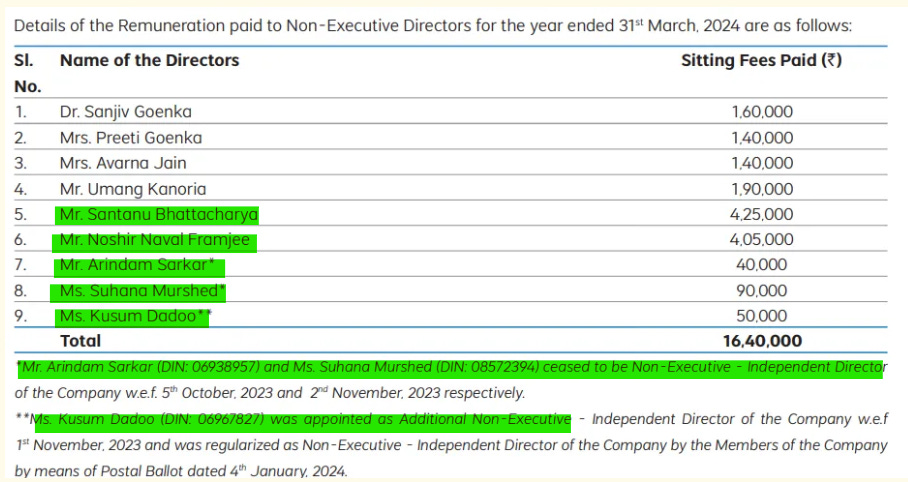

6. The following were the salaries of the Non-Executive Independent Directors:

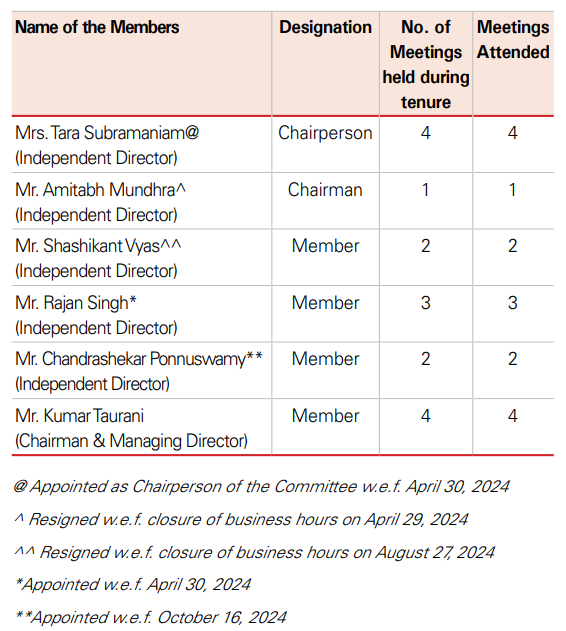

Details of number of Meetings attended during tenure - full 100% for all members

As a smoke check, lets compare the profiles and remuneration of Saregama India, a close competitor, similar in size to TIPs Music. Do note for Saregama we will be using details from FY2024 AR which is the most latest available at the date of writing.

The sitting fees given to directors of Saregama is in line, although TIPs pays a bit more in the way of sitting fees probably due to lesser number of independent, non-executive directors.

Except for resignation of two directors, TIPs Music hadn’t changed any director.

Chairman & CEO/MD are the same person i.e. Mr. Kumar S. Taurani, who also doubles up as a promoter. Hence no brownie points for this.

Promoter Checks: Here we check components of the promoter’s salary and their involvement in past frauds/scams

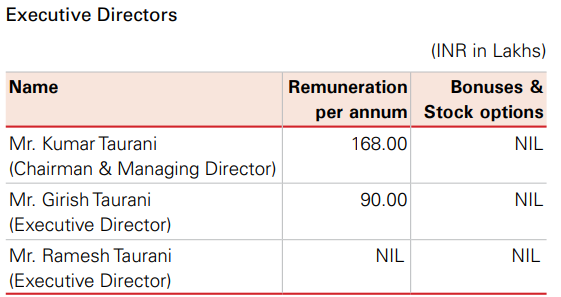

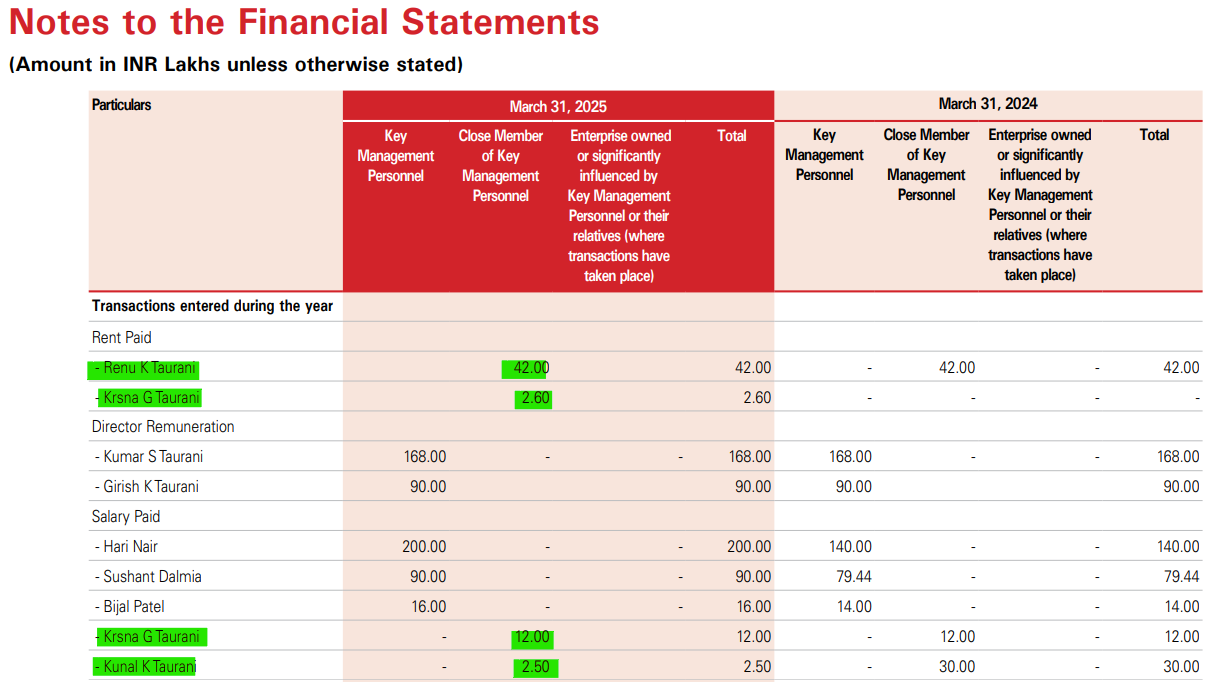

For FY25, the promoters were entitled to the following salaries:

But this does not represent the true payout because when we probed into Related Party Transactions (RPT), we see close members of the promoters being remunerated via rent and salary which ‘may not’ be commensurate with the real value they add.

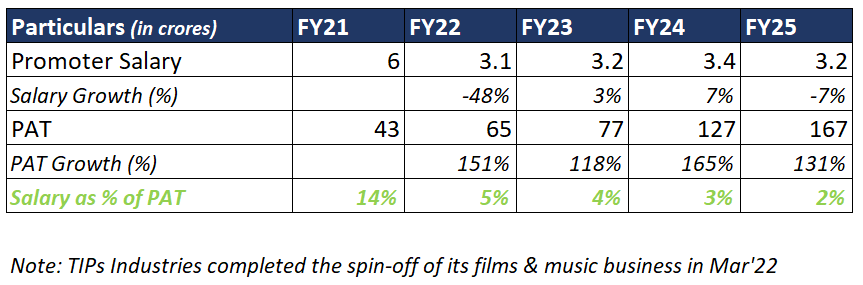

The table below shows the growth in the salary of the promoters as well as their remuneration as a %age of PAT. In addition to the promoters, the total salary component also includes the salaries, rent and any other type of fees paid to close members and relatives.

From the above table, we find comfort from the fact that the salary of the promoters remained constant across the years. Note: the Music & Films business of the Co was demerged as of Mar'22 which explains the drop in promoter salary post FY21. The salary of the promoters was likely to be proportionately divided amongst the two split entities.

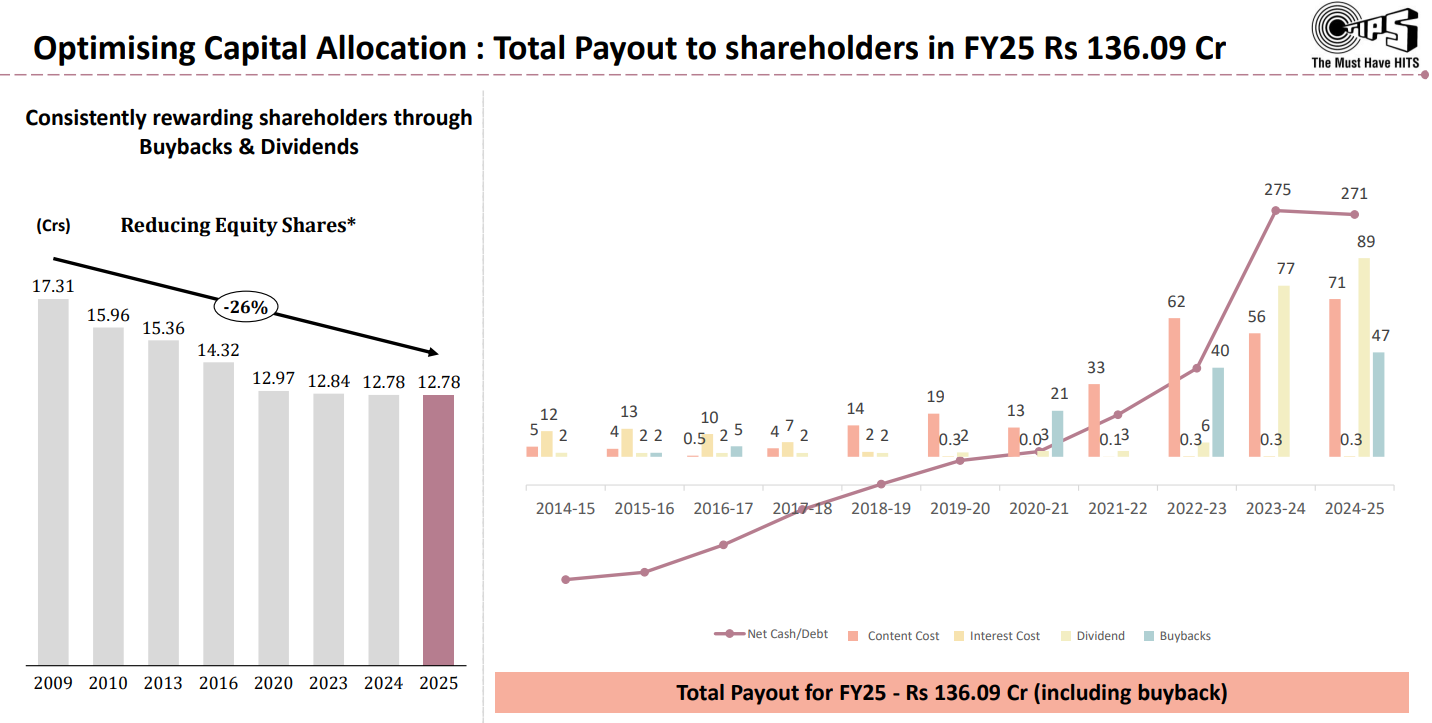

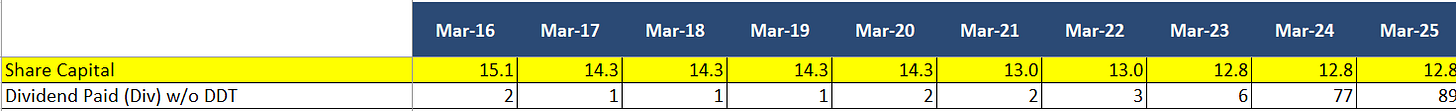

Instead of salaries, the promoters chose to reward themselves in line with other shareholders via consistent buybacks and dividend payouts throughout the years; with total payout (including buyback) of ~₹136 crores for FY25 alone. 🫡

2. Upon pouring through the last 5 years of Corporate Governance Report we found out that the remuneration of promoters consisted only of the above-mentioned amounts and no other ancillary payouts (including no bonuses, stock options, company car, vacation etc.). This is a sign of good governance.

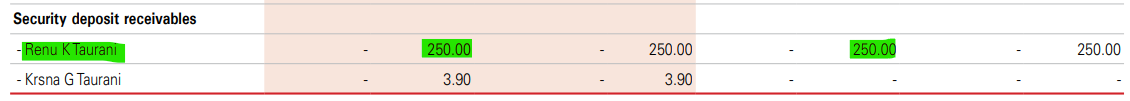

3. The following material transactions come out upon examining the various line items in the RPT:

Deposit receivable from Renu K. Taurani to the tune of ₹2.5 crores have been pending since the last four years. As of FY21 and before it was higher at about 5 Crs. Its likely that the Co might not be receiving adequate interest on the same.

Advance against Video Rights which has been to the tune of ₹5 Crs to ₹15 Crs during the last 4 years. This might be an arms-length transaction with TIPs Film and does not necessarily raise suspicion.

There is no other material transactions or indication that RPTs has increased throughout the year, which is a plus!

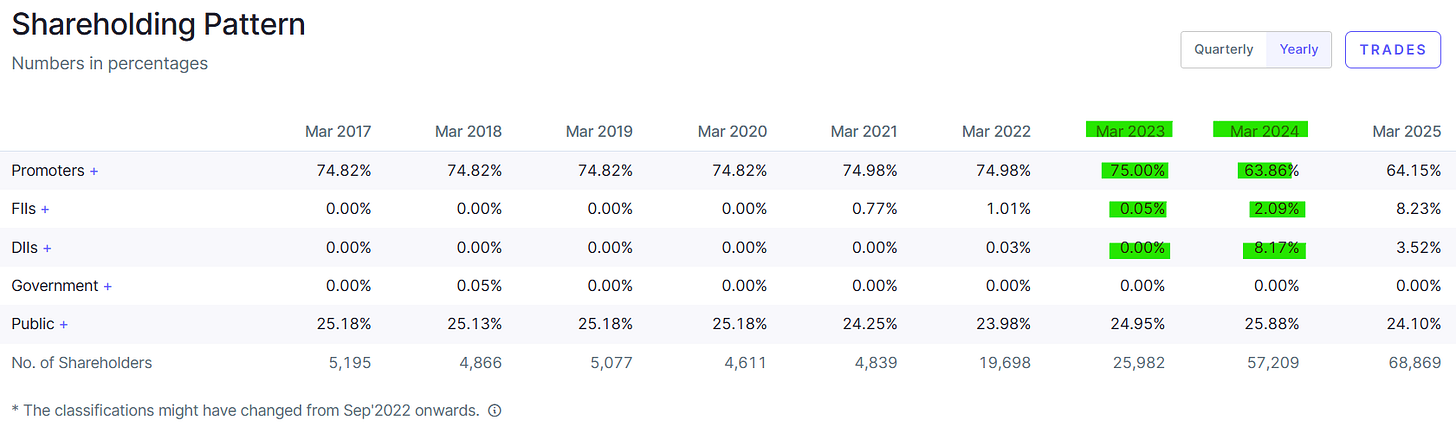

4. Promoter buying/selling pattern across the years is distinctly available in Screener as shown below:

The promoters owned 75% of the Co till December 2023, after which they sold about 11% of their shares to DIIs like SBI & Motilal Oswal and about ~2% to FIIs. The increase in promoter holding in FY25 against FY24 is due to the impact of buybacks during the year.

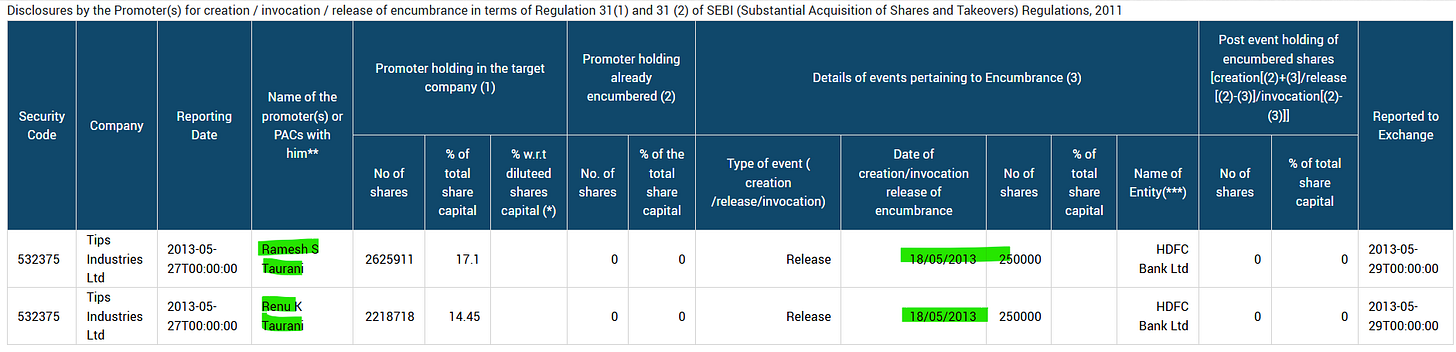

5. Information on pledging can be found on the BSE corporate filings page. Based on the archives we can see that the latest record of any pledging activity was way back in 2013.

Promoters typically pledge shares to meet various financial needs, both for their company and for personal reasons. Instances when other fundraising options are limited or expensive, urgent cash requirements or period of economic slowdowns or tight liquidity is when promoters tend to pledge their shares.

Market usually percieves pledging negatively due to risks such as margin calls, forced selling, loss of promoter control and potential diversion of funds. The case of Subhash Chandra Goenka and Zee Entertainment serves as a grim reminder.

In regards to share dilution, there hasn’t been any in the recent past, with share capital decreasing across the years due to consistent buybacks.

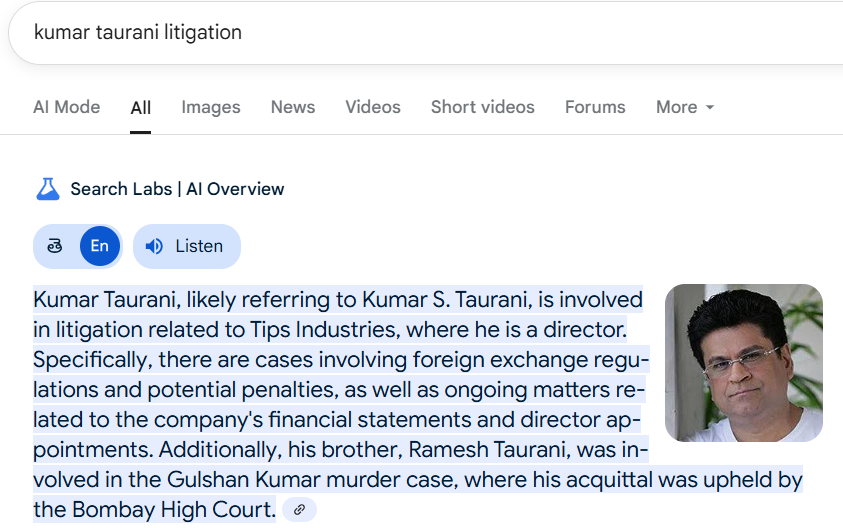

5. Upon a google search we found the following records in the names of the Taurani Brothers:

Given this is a public forum and we are not legal experts we will abstain from commenting further. The reader can dig further in these matters based on their interests.

Though in passing we’ll remark that, doing business in India isn’t so straightforward and its common (doesn’t make it right still) for promoters to be embroiled in some legal controversies or the other. This is a key monitorable but based on other facts, is not a cold, hard pass on the stock.

Based on information given in the annual reports we do not find much in the way of Key Management Personnel (KMP) changes. A change of CFO and an appointment of CEO, Mr. Hari Nair were notable changes in the last 4-5 years. Tips Music is a promoter led business primarily run by the Taurani brothers. In the last few years, Mr. Girish Taurani from the 2nd generation has joined the business and is in-charge of the overall responsibilities of operating the Music and Digital Business of the Co.

The Company reports standalone financials and is held directly by the promoters and not through inter/cross-company holdings. An example of a convoluted structure, by design is that of PDS Ltd, where the Co has about 120+ subsidiaries.

Employee Sentiments & Wellbeing: How the Co treats its employees and what employees think about the Co

Here’s a snapshot of the profile from Glassdoor - an online community for workplace conversation - which also doubles up as an excellent site to gauge employee sentiments and work culture in a company.

Given only 7 reviews with some dating back to pre-COVID times, we can’t draw much out of it. Plus most of the reviews were 4 or 5 star reviews with the average dragged down by a couple of 1 and 3 star reviews. You can find the glassdoor reviews here.

However, one thing that was consistent even in the 1 star review was the benevolence and approval of the Taurani brothers. They are well liked by the employees, some of whom have stayed with the Co for 30+ years. On the con side certain things came up consistently such as ‘Unproductive employees not fired’, ‘employees who take undue advantage of the goodness of the company’ etc.

We might be outspoken but based on the reviews and conversations we had with employees the culture seems to be of a ‘Lala Co’. However, with the second generation, like Mr. Girish Taurani coming into place that culture might change, albeit in the long term.

Here’s a few data points to know about the employees:

The no. of employees on the rolls of the Co a/o 31, March’25 was 59.

Other than Permanent employees was 42 as of the same date.

The %age of females w.r.t the total was 33% in both the groups.

The average increase made in salaries of employees other than managerial personnel in the financial year 2024-25 was 19.33%.

100% of the permanent employees and 95% of the non-permanent employees were covered under health insurance. Also, 100% of the permanent employees were covered under PF & gratuity.

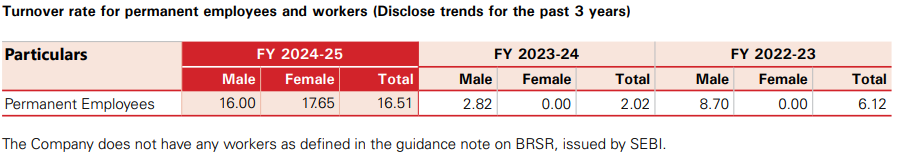

Turnover rate of employees across the last 3 years were the following:

Conclusion

This brings us to the end of our checklist. Tips Music checked the box on most of the KPIs except a few such as promoter’s history and perhaps an archaic ‘Babu’-esque work culture. However, the Co does hit home runs on key monitorables like conservative remuneration, intensity of RPT, shareholding, consistent dividends and buybacks, clean financials and a strong board of directors.

Based on the same, we score the Co. a 8/10. Please note that to get maximum benefit from this article, an investor should focus on the process of analysis instead of looking for good or bad aspects of the company. Learning to interpret the various types of data, pay attention to the parts of annual reports etc., used to get the information will improve his/her stock analysis skills.

The Next Steps: Further Readings

Suggested Read: Guide to corporate governance by

is an interesting piece which delves and compares the principal-agent problem in corporate governance. Also, breaks down the good and bad of board structures, remuneration policies, baord independence etc. observed across different South Asian countries. Consider giving it a shot!Also, Do Check Out Our Newsletter

We write a blog/newsletter on Indian small & micro caps, turnarounds & special situations that helps readers build & grow their wealth. Novice investors have told that they find it educative and actionable.

The real value though is for serious DIY investors who are have a portfolios of ₹2+ lacs in direct small & micro cap stocks. We guarantee you'll find more than a pearl or two.

For full accountability, we also publish quarterly price returns and updates on every newsletter stock we hold.

Question - Which of these checks did you find the most insightful? Which ones did you already use? Suggest a few checks that we missed out? Share in the comments 👇

📌 PS - If you found this post helpful, would you please consider restacking it and sharing it with your audience?

This spreads the word and keeps us writing about investing and the markets that will help you grow our Substack and make you a better investor. 🙏

Disclaimer: The information contained in this article is not intended to constitute any investment advice nor designed to meet your personal situation. Please do your own research or consult a financial advisor before considering any investment options.