[Part 2] The correction is unlocking bargains. Here's what's on my list and why

Thematic bets around music streaming, water supply and treatement, offshore drilling and pre-engineered buildings

In part 1 of the series I highlighted certain companies which had high near-term earnings visibility and others which were in the middle of turnarounds. In this part, I’ll delve into a few thematic plays which I am actively tracking.

Thematic stock plays involve investing in sectors or companies that are expected to benefit from specific macroeconomic trends, policy changes, or structural shifts in the economy. Stuff like renewable energy, EVs, healthcare infrastructure, digitization, data centers and the like. But these tend to broad themes and are already priced in the markets via high PEs.

Value lies in finding and betting on the niche, micro segments within these broad themes. Often than not, some of these niches are under-researched and priced and are overlooked in lieu of the poster stocks.

The following is a list of such small, profitable, well-capitalized cos, engaged in niches of sectors which are enjoying huge tailwinds.

Before we begin, we would like to iterate that none of this construes as an investment advice. Please do your own due diligence before investing in these companies.

Now let’s go:

Theme 1: Digitization

Niche: Music Streaming

In 2023 Indians spent 24.4 hours a week listening to music, which was 18% higher than the global average.

Streaming is the latest evolution of the Music Industry. Consumption pattern has changed from buy/download-consume specific music to something what is called as access on demand, wherein entire library of songs is available for consumption at a click.

Music streaming apps in India had a base of 18.5 crores out of which only 75 lacs were paid subscribers in 2023. Similar to what happened in OTTs, we believe there will be a shift in consumption of music to streaming within the broader population. Presently, majority of revenues earned by streaming platforms are via in-app, ad-supported music. The bet is that in next few years, a substantial amount of free users will turn into paid subscribers. As per EY, the market has the potential to grow the number of paid subscribers to 2- 2.5x their current volume in three years (1.5 crores paid subs) and four to five times in five years (3.5 to 4 crores paid subs). The revenues of these streaming companies in turn would increase at much higher multiples as margins for paid subscriptions are higher than advertisments.

Also, this shift from buy-download-consume to streaming is effected by a couple of broad reasons.

Convenience-as-a-Service: Longer ads in YT, Spotify’s restrictions to free users in India – inability to play songs in a particular order in a playlist, repeat tracks, return to previous songs, or move to a specific part of a song to listen. All this creates friction in the listening experience which prompts users to shift from free to paid. This is similar to the reason why you pay 20-30 bucks extra on Blinkit rather than getting your groceries from the Kirana shop on the opposite road.

Bundled services: Increasingly subscriptions are being bundled with related. For example, in certain Jio/Airtel wifi packs you get Amazon Prime/Netflix/ Hotstar attached. The same for mobile data subscriptions. Also, convenience to buy these streaming subscriptions via family/group plans which enables services on multiple devices is enabling this transition.

Tips Music Ltd: is in the business of production, acquisition and distribution of music rights. The co has a large music library with a collection of over 31,000 songs across various genres and regional languages. The Co earns revenue by licensing out its music library to various streaming platforms such as Spotify, YouTube Music, Apple Music etc. and also to companies such as Instagram, Facebook, YT Shorts, TikTok etc. where users employ these music in video and reels creation. It also earns through sync deals via TV and public performances. A ‘sync deal’ (short for synchronization license) is an agreement that grants permission to use a song in a visual medium like film, TV, commercials, or video games, in exchange for a fee and potential royalties.

Why we like Tips Music: Management has guided a 25-30% revenue growth p.a for the next 5 years with EBITDA margins over 60%. Furthermore, all this is done through internal accruals and the co has zero debt. Tips also pays dividends each quarter and has bought back its shares in 3 out of the last 5 years.

The co also follows prudent accountiung practices. For instance, in order to increase its catalogue of music, the Co periodically acquires music rights from producers. But rather than typically ammortizing it off across few years, the co writes off 100% of the content costs from the P&L account within the same quarter i.e. no capitalization & no pending write-offs in the future.

Risks: The business faces two major risks:

a) Content obsoletion: Compared to Tips’s catalogue of 31k+ songs, Saregama India and T-series music boasts 150k+ songs each. This leads to more clicks and views on their catalogue compared to Tips. Also, the management states that 80% of the revenues come from old music of the 1980s and 90s. Hence if the company is not aggressive in new content acquisitions, Tip’s music catalogue may face obsoletion from new age users.

b) Copyright infringement/piracy : Illegitimate downloads, piracy, stream ripping sites, unlicensed usage strip away earnings of these companies. However, Indian IP laws have grown stronger and there are currently much stricter checks compared to before.

Note: ~15% of my portfolio is invested in the co.

Theme 2: Water Supply & Infrastructure

Niche: Waste water treatment

India has a water problem. Be it in water shortage or waste water treatment, collection or disposal. Some cities flood during monsoon while others face severe scarcity in the dry months, while aging infrastructure struggles to keep up with growing demands.

As per the latest report of the Central Pollution Control Board (CPCB, page 55), as of 2020, the country generated 72,368 million litres of waste water per day (mld). Against this we had a treatment capacity of only 26,869 mld available, out of which 20,235 mld is actually utilized. This means only ~28% of waste water is treated and the rest is dumped into nearby rivers and waterbodies. A further 8393 mld of capacity is however under construction (3,566 mld) and others at proposed stage (4,827 mld).

As of 2024, say we take the waste water generated to be constant and assume the proposed capacities to be complete and fully operational; both of which are unlikely assumptions. We would still have 72,368 mld of waste water against 36,668 mld of treatment capacity which is only ~50% of the gap. Furthermore, there is an uneven distribution of treated capacity with the top 10 states contributing 86% of the total capacity.

Also, operation and maintenance of existing plants and sewage pumping stations is also a very neglected field; with nearly 39% plants not conforming to the general standards. Plants are usually run by personals that do not have adequate knowledge of running them and know only operation of pumps and motors. The governemnt is cognizant of all this and have focused on bolstering our water infrastructure capabilities via schemes such as Jal Jeevan Mission, Atul Bhujal Yojana, Jal Shakti Abhiyan etc.

EMS Ltd: Established in 2010, EMS Ltd. is an EPC company engaged in the business of providing turnkey solutions water supply, sewerage, waste water treatment and its subsequent maintenance. Its work includes design, construction, operation and maintenance of Sewage treatment Plants (STPS) & Water Treatment Plants (WTPs), laying of pipelines for supply of water etc. The company recently has been foraying into design and construction of power transmission, real estate and road/allied works.

As of Dec’24, though the group enjoys a healthy unexecuted orderbook of ~Rs 2500 crore, orders worth ~Rs 512 crore are such where execution is yet to commence.

Why we like EMS Ltd: ~20% PAT margins, low debt and healthy orderbook.

Risks: Working capital management and ability to bid for lucrative govt and overseas contracts.

I wrote in detail about this theme, the quantum and type of investments by the govt, how EMS boasts a 20% PAT margin despite being in the EPC business, why it suddenly bought a paper mfg company and a sketch estimate of valuation. You can find all that here.

Theme 3: Infrastructure Construction

Niche: Pre-Engineered Buildings (PEBs)

PEBs are steel structures fabricated in factories and then assembled on-site. They are gaining popularity due to their speed of construction and sustainability. The global pre-engineered steel buildings market is estimated at $16-17 billion as of 2022 and is expected to grow at an 11-12% CAGR over the medium term till 2027.

As for India, its PEB market is valued at approximately ₹195 billion in FY24 and is projected to grow to ₹340 billion by FY29. This is due to a combination of low share of pre-engineered buildings in India combined with the increasing awareness of benefits & cost savings in pre-engineered buildings over Reinforced Cement Concrete (RCC). PEBs find application across various segments:

Comparing between RCC and Pre-engineered Steel Construction

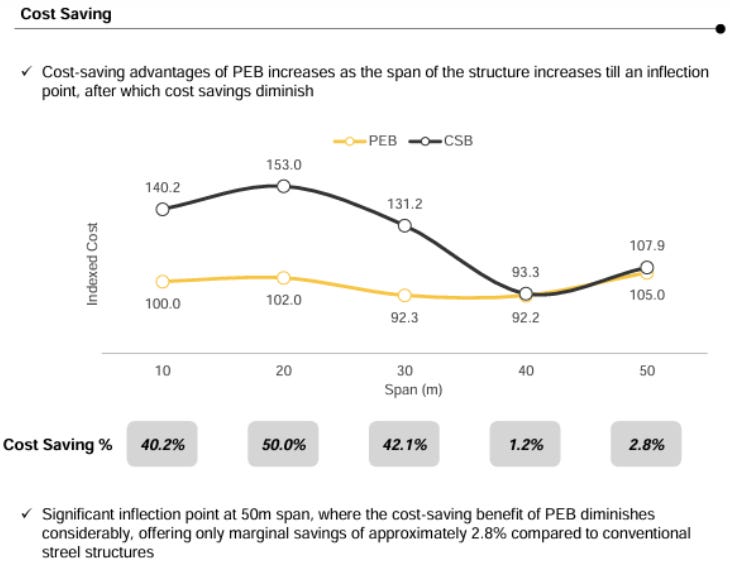

There is a significant cost savings in PEBs over RCC ranging upto a span of 30m:

Interarch Building Products Ltd: is a leading turnkey pre-engineered steel construction solution providers in India with integrated facilities for design and engineering, manufacturing, on-site project management capabilities for the installation and erection of pre-engineered steel buildings. The co had the second largest aggregate installed capacity of 161,000 metric tonnes per annum as of Dec’24 with an additional 40,000 MTPA underway. The Co’s total order book as on January 2025, was ₹1,305 Cr compared to revenues of ₹1293 Cr in FY24. 81% of this FY2024 revenues were repeat orders which shows product acceptance among customers. The Co has a ~7% market share among integrated PEB players in India with 677 completed PEB contracts between FY15 and FY24.

Why we like Interarch: For starters, management is guiding for doubling topline in 3-4 years with bottom-line growth outpacing topline growth. Plus there are strong tailwinds in the industry with the broader PEB market in India expected to grow at 11-12%. The Co has a healthy orderbook backed by capacity expansion to service the same. Interarch is debt-free, has no significant related party transactions, and average promoter remuneration as a % of PAT is below typical small cap standards (FY24: 3.33%, FY23: 2.7%).

Risks: Steel constitutes 87% of the raw material cost and steel prices tend to be volatile. Plus roughly 70% of the company’s contracts are fixed-price contract. As such surge in the price of steel will affect the co’s margins. The PEB industry is just a sub-segment of the construction industry which is cyclical in nature. While govt capex was been the demand creator for the past years, the baton is expected to pass over to private players. As such fall in capex will hurt the prospects of the co.

80% of the company’s revenue are repeat orders and 25% of the company’s topline derive from the top 5 customers. As such, the bargaining power of its customers are higher and the co may have to accept relatively unfavorable terms in future contracts.

Theme 4: Oil & Gas

Niche: Offshore Oil Exploration

Here’s a brief history of oil prices:

Since 2003, growing demand from emerging economies of China, India & Brazil among others pushed oil prices to a peak of $144 per barrel by July 2008. Only to see it tumbling down to $40 per barrel by December 2008, courtesy the GFC. Economic recovery picked pace in 2010 and coupled with the Arab Spring uprisings (markets fearing cuts in production) oil prices stabilized at $100 per barrel during 2012-14. However, oil prices began to decline in late 2014 due to excess supply, driven by shale oil production in the United States and OPEC witholding any prodcution cuts.

All this led the price of Brent to slip below $30 a barrel in January 2016 to levels not seen since 2003. Just as prices began to slowly recover, touching the $75 per barrel mark, COVID-19 hit and brought the entire oil and industry to its knees. Due to being in a capex heavy industry, offshore drilling companies are particularly supeceptible to sustained downturn in oil prices. Many companies were on a huge spending spree leading upto that period, heavily investing in everything from submersible and deep water rigs financed by ‘shiploads’ of debt.

The offshore rig industry thus went through very tough times when the oil industry went through the extended downcycle from 2014-21. The excess supply of rigs against a protracted demand downturn was worked off through bankruptcies, debt restructurings, mergers and asset retirements.

From 2014 to 2018, during the deepest period of the rig market downturn, there was a yearly average of 43 rigs – jackups, semisubmersibles (semis) and drillships – permanently removed from the active fleet, mostly through scrapping or conversion for non-drilling purposes. Rig demand began to show signs of improvement during 2019. However, in 2020 the coronavirus pandemic obliterated rig demand and with it came a 35% jump in rig attrition against the previous year. Between 2020 and 2021, the average age of rigs being retired fell to an all-time low, and during this time we saw drillships as young as eight years old being removed from the active fleet.

Post the chronic downturn from 2014-20, a rig market upcycle began in the latter half of 2021; which is still persisting today. This is driven by a combination of increased offshore spending and a shortfall of jackup rigs which I have detailed here.

Jindal Industries Ltd: Jindal Drilling & Industries Ltd (JDIL) is a service provider in the upstream segment of the offshore oil & gas industry. The company provides rigs on charter hire basis to ONGC (which is its sole client as of date). JDIL operates 5 jackup rigs which are currently with ONGC. A jackup rig is a specific type of an oil rig which drills oil from the earth’s surface. These rigs can be located either on land (onshore) or water (offshore). Jindal Drilling has a fleet of jack up rigs dedicated to offshore drilling which extracts oil from shallow water ocean beds.

2 of the 5 rigs are owned and the others are rented. It also owns another rig (Jindal Pioneer) via its JV which is deployed in Mexican waters and operated by another oilfield services company, Saipem. It makes the highest EBITDA margins on the owned fleet.

Why we like Jindal Industries: I believe JDIL has good prospects for strong earnings in the medium term. The current demand-supply dynamics of the offshore oil and gas industry presents an opportunity for high daily rental rates. As given above, Jindal Supreme and Virtue 1 had recently recontracted with ONGC at much higher rates (~2x). Coupled with expected upward reneg on Explorer’s day rates post contract end in May’25 (new rates to kick off by Sept’25) + potential acquisition of Pioneer from JV (discussed later) would entail a sustained, higher EBITDA.

If this upcycle sustains post H1 ‘26, contracts for Jindal Virtue and Star will also be reneged at higher prices.

Risks: Oil prices falling down from a cliff, stagnating E&P spends by ONGC, execution risk in terms of renewing contracts and fulfilling contract obligations. The Co also has a contingent liability of ~160 Crs agisnt ONGC pending final order from Supreme Court. 50% of this contingent amount (~80 Cr) is held as FD by the Company in anticipation of the final order.

I wrote in detail about the company, its near-term prospects and risks in almost exhaustive details. You may find it here. I hold ~7% of my portfolio in this company.

That’s my time. Until the next article.