Rategain Travel: A 3x in 3Y Opportunity?

Issue #13 explores the business, playbook and the opportunity in Rategain, a platform business in the global travel and hospitality industry ✈️🧳

High Operating Leverage ➕ Low Capex/WC Requirements➕ High ROCE

🟰 Asset Light Businesses

➕ Low Debt ➕ Sticky, Scalable SaaS/ Platform businesses

🟰 Good Asset Light Businesses

➕Attractive Valuations

🟰 Asset Light Businesses that Gets Us Excited 🤩🤸🏻💰

We believe that Rategain Travel Technologies Ltd. is a strong candidate to being one such.

About Rategain

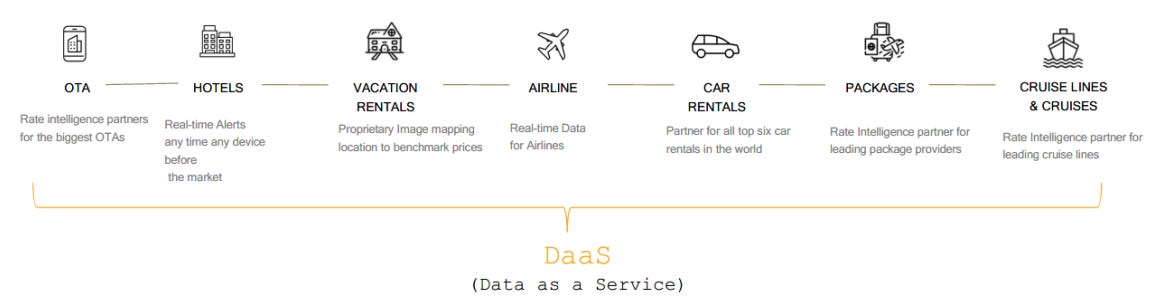

Rategain offers B2B travel and hospitality solutions to a wide spectrum of customers including Hotels, Airlines, Online Travel Agents (OTAs), Meta-Search Companies, Vacation Rentals, Package Providers, Car Rentals, Rail, Travel Management Cos, Cruises and Ferries. It is one of the largest aggregators of data points in the world for the hospitality and travel industry.

Essentially, they cover the entire value chain of the travel and hospitality industry. Their offerings can be categorised into three main services:

DaaS (Data as a Service): Tracks over 370 billion+ (as of Mar’24) data points such as pricing, ratings, rankings, availability, room descriptions, cancellation policy, payment policy, discounting and package inclusions. It uses this data to indicate travel intent and enable dynamic pricing for Hotels, Airlines, OTAs, Car Rentals, Tour Operators and Cruises.

Example: The ability to match market pricing is a critical factor in attracting and retaining customers in a price-sensitive market. As such hotel chains may leverage travel intent data to understand when guests are likely to visit their area and what their competitors are charging for similar rooms.

An airline may require access to detailed information on market trends and competitor pricing strategies to enhance their own pricing decisions and boost revenue.

Distribution: A central platform for Hotel Chains, OTAs and Corporate Travel Agents to communicate availability, rates, inventory and process bookings across multiple platforms. The platform helps to effortlessly distribute availability, rates, inventory, negotiated rates, cancellation policy, amenities, attributes, images and description, all in multiple languages to demand partners.

Example: A hotel chain updating real-time prices and inventory for a wide range of properties and synchronizing this information across various booking platforms for consistency and reliability.

Also, for instance, when offering a last-minute discount on a package tour to Bali, a hotel chain can update the price and availability across all platforms simultaneously from a single interface, ensuring consistency across multiple channels.

MarTech: Under this segment, it provides a platform for active management of client’s digital assets and campaign management through AI based solution to increase awareness, engagement and sales that help in personalization of guest experience. Further, the Co helps hotels manage their brand on social media and metasearch platforms (like Google & TripAdvisor) and enhance direct bookings, especially for luxury hotels through optimized social media campaigns targeted at both value-driven and experiential high-end travelers.

Example: Say you’re a manager of a skiing resort in the Alps. Rategain’s MarTech services helps you launch targeted advertising campaigns on social media platforms. By analyzing data on travel intent and past guest’s booking behaviors, the service identifies target audience with higher chances of conversion and craft personalized email campaigns and social media ads highlighting special skiing and related activities.

This increases the likelihood of direct bookings and enhances appreciation for the brand owing to the personalization.

Contribution of Different Segments as % of Revenue

A Brief History of Rategain

A finance and computer science graduate of Indiana University, Bhanu Chopra started his career at Deloitte Consulting in Chicago before co-founding a private consulting firm, Riv Consulting, which advised organizations on the integration of customer relationship management (CRM) software in enterprise systems. It was during this initial stint that Bhanu used to head out for short trips during the weekends.

Looking for travel deals at the time; he realized that no website aggregated deals for travelers across different websites of online travel agencies. Thus, the idea for Rategain was born.

Rategain was founded in 2004 in a 3-bedroom apartment in Delhi. The company started as a consumer-facing website that provides low-cost deals but quickly pivoted into a B2B service to provide competitive rates to Online Travel Agencies (OTAs) to out compete competitors and acquire more customers. It soon expanded from hotels to car rentals, tour operators and airlines.

Notably a profitable company, it was bootstrapped until 2014-15 when it raised $50 million from PE firm TA Associates.

The funds in addition to expanding operations overseas and developing products were primarily raised to acquire firms that had built solutions for the travel and hospitality industries. In spite of raising funds in 2014, the company displayed discipline in a then overheated startup market and waited for 4 years before its first acquisition in 2018.

Till then, while travel companies started having access to competitive rates, distributing them in a timely fashion continued to be a challenge. Hotels and airlines realized that the monopoly of large travel operators who dominated the share of online bookings had ended, and local e-marketplaces of travel products were the new norm—where each e-marketplace catered to a specific audience and travel suppliers had to reach these e-marketplaces and ensure they were visible to them. Bhanu’s vision was to build Rategain as an integrated end-to-end revenue maximization technology platform for travel suppliers.

As such the Co’s first major acquisition was DHISCO in 2018. DHISCO was a hotel distribution technology company, which helped Rategain to expand operations to hotels and OTAs in Asia by upgrading and integrating it with their distribution business. DHISCO (formerly THISCO) was founded in 1988 as the consortium of the largest 16 hotel chains at the time to process hotel transactions electronically by linking the hotels’ central reservation systems to the electronic catalogs of global hotel and airline inventory known as Global Distribution Systems (GDSs). DHISCO turned profitable following its acquisition.

The following year in 2019, Rategain acquired BCV, a social media monitoring, analytics, and content marketing company that served luxury and boutique hotel properties. The company integrated this with its Martech offerings and extended its offerings to their customers globally.

Just as Rategain was gaining recognition among large clients, the 2020 pandemic hit. Both international and domestic Tourism fell off a cliff and had severe ripple effects on everything from airlines to hotels to car rentals to local economies of entire destinations.

Despite being contingent on the performance of its clients, hotels, airlines, cruises, and OTAs, Rategain was relatively unscathed compared to other participants in the travel industry. It did incur losses but not to the bloodbath extent that other players witnessed.

It also saw the company using its data to predict travel demand and provide insights on the travel industry’s responses to the pandemic restrictions and travel recovery. The company collaborated with leading publication houses and tapped mainstream media to tell the world how travel was coming back. By the end of the campaign, Rategain generated over 6,800 downloads for its reports and engaged 17,500 attendees across 40+ webinars.

In 2021 the Co completed the acquisition of Myhotelshop, a German company which offers hotel MarTech solutions across ad bid management and campaign intelligence for sponsored ads on metasearch sites such as Trivago, Kayak, Tripadvisor, and Google Ads, which aggregated hotel rates across direct and indirect channels for a fee per click, and thus allowed hotels to manage their acquisition efforts more seamlessly across paid search, social media, and third-party platforms.

Later in the same year, it filed for an IPO of ~1,336 crores bifurcated between 375 crores of fresh issue and ~961 crores of Offer for Sale.

More recently in 2023, Rategain acquired Adara, providing access first-party data for commercial teams across the travel and hospitality industry. Adara’s data was used by marketing, distribution, and revenue management teams to identify demand trends, curate audiences and improve revenue per available room (RevPAR). Adara’s offering aligns with the company’s DaaS and MarTech segments and strengthens their value proposition.

In Nov 2023, Rategain raised up to Rs. 600 crores via QIP with a specific focus on strategic investments, acquisitions and inorganic growth.

However, since then the company hasn’t made any acquisitions with the money stating that current market valuations are still high. Over the last few con-calls, the company has been insistent that it does not want to overpay for acquisitions and want to align with its payback period and IRR criteria. This remains a strong optionality for the Co.

The Business Model

Rategain leverages three main revenue models:

Only Subscription Model: Here clients pay a recurring fee to access a suite of products. This model provides a predictable revenue stream. The subscription services typically include access to software that aids in revenue management, rate intelligence, and brand engagement across digital platforms.

This only includes revenue from the subscription model and does not include revenue from the transaction and hybrid model.

Only Transaction Model: In the transaction model, Rategain earns revenue from bookings made through its platforms. This model is particularly relevant in the context of Rategain’s distribution capabilities, where it connects hotels and other accommodations with various travel agencies and booking platforms. Revenue is generated from each transaction or booking, providing a dynamic revenue flow that aligns with the fluctuating volumes of travel bookings.

This only includes revenue from the transaction model and does not include revenue from the subscription and hybrid models.

Hybrid Model: Recognizing the varied needs of its clients, Rategain also offers a hybrid model. This combines a minimum subscription fee with a pay-per-use component. This flexibility allows clients to scale their usage based on seasonal demands and specific needs without a significant upfront cost. The pay-per-use model includes access to additional, high-value data or advanced analytical tools that provide deeper insights into market trends and consumer behavior.

This includes revenue from the subscription model and pay-per-use component.

Notably, Rategain’s subscription revenue (this includes revenue from only subscription model + revenue from the hybrid model) has been on a declining trend with FY25 at 57.5%. This is a key monitorable.

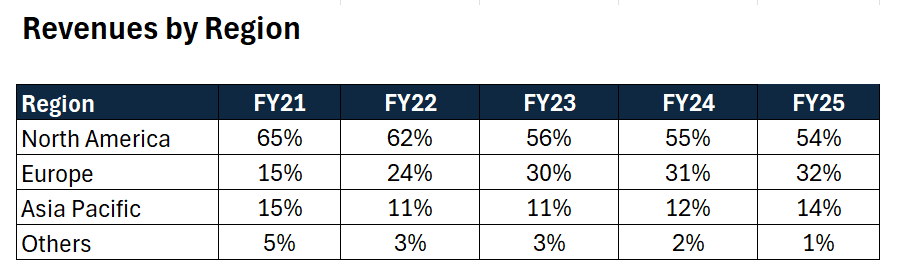

Although, more than half of the Co’s revenue is still derived from North America, the Co has meaningfully lessened this concentration over the years from 65% in FY21 to 54% in FY25.

Rategain’s revenue distribution by customer type for FY25 shows that 29.5% of its revenue comes from the top 10 customers, while the remaining 70.5% is generated from a broader customer base. This ratio was roughly the same for FY24 as well.

Notably, revenue contribution from India is less than a percent.

An analyst asked why the contribution from India was less given the increased emphasis on tourism by the government. Management replied that they are evaluating a different go to market strategy as the subscription fees type set up won’t work. However, the company is exploring a transaction type of model on the distribution side, where it may charge a %age of business that Indian hoteliers get through Rategain.

(Source: Q4 FY25 con call)

Some Other Key KPIs

Gross Revenue Retention (GRR) - denotes percentage of renewed revenue as compared to previous Fiscal

Net Revenue Retention (NRR) - Denotes percentage of incremental revenue from same clients compared to previous fiscal

LTV-to-CAC is computed by i) Multiplying Gross Margin from New Sales with expected lifetime of the contracts to arrive at LTV ii) CAC is calculated by dividing sales and marketing costs by no of customers added.

An NRR consistently above 100% (except COVID year 2021) shows that the Co has been able to make more revenues from its existing base of customers y-o-y. It also means upsells/ cross-sells and expansion has been over and above downgrades and churns.

An LTV: CAC of 4-6 is generally considered healthy. In case of Rategain this has been over 10 for the last 4 years. This measure is a proxy for stickiness of customers and optimized marketing costs.

Both the above metrics are encouraging.

The Co also works with marquee customers as given below:

Competition

Before talking about competition, I would insist the reader to spend 5 mins on the Co’s website to understand their various products. If you don’t want to that’s fine; do check it out later.

Rategain competes in a robust marketplace with several key players such as OTA Insight, Fornova, TravelClick, SiteMinder, and DerbySoft. Each of these competitors operates in various segments like Data as a Service (DaaS), Distribution, and Marketing Technology (MarTech).

As seen from the above chart, what sets Rategain apart is its integrated coverage of all the segments combined with trust and scale. This enables Rategain to leverage vast amounts of data from different touchpoints in various parts of the value chain in two ways:

First, this extensive data collection enables more informed and effective decision-making, enhancing product development and customer service.

Second, this wide-ranging presence facilitates cross-selling opportunities, allowing Rategain to offer bundled solutions that are not possible for competitors who specialize in narrower fields.

All of this sounds good on paper!

Given Rategain competes globally with other providers we snooped around a bit to compare how does it fare against its competitors. We came across a report by Hotel Tech, here. Hotel Tech ranks each product within categories with a proprietary ranking algorithm, the HT Score. The linked article details their robust rating system which we understood to be highly indicative of best-in-class experience and user appeal.

Hotel Tech ranks each product in categories such as: Operations, Revenue Management, Guest Experience, Marketing, Meetings & Events, Vacation Rentals, Food & Beverage, HR & Staffing etc.

Within which Rategain’s category include Revenue Management and Marketing.

Revenue Management itself is sub-divided into various functions which are given in the below screenshot:

The winners for 2025 within each sub-category is as below (Rategain doesn’t feature in any):

However, it does grab 3rd place amongst the best Channel Manager and Rate Shopping Software category.

In 2024, the Co had a similar rating finishing runners up in the Channel Manager and Rate Shopping segment within the Revenue Management category, with no representation in the marketing segment as winner or finalist. Help yourself with the 2024 rankings here.

However, the Co ranked amongst the top 10 companies (10th and 9th) in the 2024 and 2025 respectively Hotelier’s Choice Award which you can find here and here.

In short, this means Rategain faces excessive competition from global players like Light House and SiteMinder among others in both the revenue management and marketing segments. They are quite far from the top players, and this should be indicative of keeping tempered expectations in the Co’s revenue growth.

In India, a notable competitor within this segment is STAAH Tech. Find the Co’s website here.

Company Financials

Is the company financially healthy? Short Answer: Yes, very much

Clean balance sheet with negligible debt

Consistent, high conversion of EBITDA to CFO

Increasing trend of operating revenues in the past 4 years

Increasing PAT margins with levels over 15% in the past two years

Cash balance of ₹1267 crores of cash as of FY25 end owing to their QIP proceeds

The company is currently in talks to acquire businesses in the DaaS and Distribution segments, aiming to find companies that are a good financial fit.

Corporate Governance

Board of Directors: As of FY24, the Co has 6 directors including Bhanu (promoter) and Megha Chopra (promoter’s wife). Out of which 3 directors are independent. All the independent directors attended 4 out of 4 meetings during the year.

Remuneration as a % of PAT: As per FY24, Remuneration as a % of PAT was ~4% across the entire promoter group combined.

Related Party Transaction: RPT is close to zero and almost no line items demand emphasis except for inter-company loans and investments amongst the Co’s WOS.

Contingent Liabilities: ₹62.4 crores of contingent liabilities in the form of claims made by ex-employees and indirect taxation. Compared to net worth of ₹1683 crores, this comprises less than ~4% which isn’t significant.

The Risks

While sectoral tailwinds, less cyclicality compared to other travel businesses, geographic diversification, integrated platform, the travel industry’s push towards data and digitization & scope for a strong acquisition etc. make a good case for Rategain, we are more inclined towards the risks.

The Co’s share price has seen a stark decline in share price in last 6 months with price falling from ₹750-ish levels to CMP of ₹430.

This recent fall in price is due to quite a few reasons:

Single digit revenue growth to the tune of 6-8% expected for FY26.

Huge investments in sales and marketing can keep pressure on the margin in the near term

A falling LTV to CAC ratio since 2023 attributed to lack of winning any big clients in the last year.

Since its QIP in Nov 2023, the Co hasn’t been able to materialize any acquisition targets stating its reluctance to overpay for any acquisitions.

Management also indicated that their distribution business will witness decline in revenues for the coming quarters. This partly due to wind up of one of the sub-brands of a large OTA and also due to repricing of legacy contracts in DHISCO.

Apart from the above, the Co also faces other significant risks such as:

Economic Slowdowns: Rategain’s revenue is closely tied to the health of the global economy, particularly the travel and hospitality sectors. An economic downturn can lead to decreased consumer spending on travel, reduced hotel stays, and overall lower demand for travel services.

This is unavoidable as economic downturns are neither predictable nor avoidable.

Geographical concentration: While Rategain caters to customer’s globally, more than half of its revenues are from North America. Any economic slowdown, geo-political tension or internal political crisis can lead to reduced demand for the Co’s services.

All that said, we do find it encouraging that the Co’s concentration in North America has been steadily coming down from 65% of revenues in FY21 to 54% in FY25.

Competition: As outlined earlier, the Co faces strong competition against various global players across many categories. Clients changing ships from Rategain to its rivals or competitors coming up with innovative products can derail Rategain’s future revenues.

While Rategain faces a deluge of rivals, its products still stand out given its integrated platform and ability to process and analyze large volumes and data in real time continues to be a key differentiator.

The AI-angle: We are currently in the 1960’s of the AI revolution. In the years and decades to come we will likely see seismic shifts in various industries of the world. The travel sector won’t be an exception. The Co’s adaptability and edge to constantly innovate and launch new products would be a key monitorable.

Amongst the many interviews and con calls, we skimmed through a recurrent theme was a commitment to being an AI-first company. In such spirits, the Co recently launched VIVA, an AI voice agent designed to help hotels convert more bookings by engaging guests in over 18+ languages, answering common and complex queries, processing reservations and confirming bookings.

The Co also launched Smart ARI which uses AI to solve for overbookings and rate parity violations. While this is less than the tip of the AI iceberg and does not carry any future guarantee, Mr. Chopra’s forward-looking vision provides comfort.

Wrong/Weak acquisitions: An important driver of Rategain’s growth strategy is to acquire other companies to enhance its own products and market reach. M&As are tricky and often turn out to be unsuccessful. Misjudging the value of a business, overpaying for it or even poorly integrating it can lead to financial disruptions and operational strain for the Co.

However, we find ease in Rategain's approach to acquisitions. Mr. Chopra has been repetitive in stating that they are not willing to overpay for acquisitions. And that they will only agree to valuations that comply with the group’s required IRR of over 20% and a payback period of five to seven years. DHISCO’s turnaround to profitability post-acquisition or acquiring Adara at 0.7 times sales to significantly augment’s Rategain’s Martech solutions, offers testament to the company’s disciplined approach.

Valuations

As of 23 June 2025, the Co is trading at a market cap of ~5100 crores. As of FY25 end Rategain clocked ₹209 crores of PAT, which imputes a PE multiple of 24.4x. However, this is not true.

The PAT consists of ₹76 crores of Other Income, which is basically interest from FDs on its large cash balance from the QIP. Adjusting for ₹1,267 crores of cash from Mcap and ₹76 crores from PAT, we get an adjusted PE of 29x which isn’t cheap.

Given, an 8% revenue growth and a deprecated PAT margin of 15% owing to marketing expenses, we get an FY26 PE of 38x after adjusting interest on FDs and Mcap. The market most certainly understands this and hence the decline in price.

However, we do not look at PE in isolation but along with ROCE and growth. ROCE at 17% is artificially depressed owing to the high cash balance which weighs on the capital employed. Also, growth expectations are muted for FY26 as per management guidance.

With all that being said, surprise in earnings can come from higher marketing and sales efforts. Management stated that the Co has built out new products and capabilities in the last couple of years and that it now requires sufficient marketing and distribution to sell these products.

Such effort has started and has included appointing new heads for different regions, instituting new Sales Development Representative (SDR) teams for cold calling, lead generation and brand awareness. A new internal team also has been constituted for closing out smaller deals so that enterprise teams have bandwidth to handle large accounts.

At the end of the Q4 FY25 con call, Mr. Chopra also guided that they had understated the sales effort required to reach earlier revenue guidance and that there had been execution challenges along with a lack of right leadership from sales perspective. Such honesty and confession from the promoter are steps in the right direction.

Final Thoughts

We hold a tracking position in Rategain Travel. Almost every box checks out for the Co, except for the valuation. Like Mr. Chopra we are adamant to overpay, and we will wait for the right valuations before we commit significant capital.

Disclaimer: These are our views on Rategain Travel Technologies Ltd. This is NOT an investment advice, just perspective. So please do your own research before making a buy/sell decision.

Thanks for sharing a fantastic analysis. Few observations and this is emerging from me analysing another publicly listed ad tech company -Affle where I see some parallels, in some ways I find Rate gain pursuing the same investment approach as affle by acquiring many different companies in the ecosystem that can compliment its offerings and perhaps even extend horizontally including different geo's in the coming days i.e. DHISCO - Asia market, BCV -Social media offering, Myhotelshop- Martech(Germany/EU), Adara -Data. Bhanu Chopra certainly seems very prudent in its capital allocation strategy when it comes to acquisitions(similar to Anuj khanna from affle) but in some ways I feel the real moat in this business is simply expanding its market cap through acquiring more companies , increasing its scale/Revenues and subsequently attracting more capital for more acquisitions thereby making a virtuous cycle. There is nothing wrong per se in this approach but I would then monitor their pre/post acquisitions and see how value accretive it translates into.

If you look at affle as a corollary, they have basically been able to scale its revenue by and large by acquiring companies (since their IPO) in the adtech ecosystem that compliment their offerings and expand into other Geos.

That's not to say, rate gain won't be a winner in the long run as a matter of fact affle has been a 10x since it IPO. Mr Chopra will be the person to watch for.

Hi team,

Good analysis on every aspects from business to governance to competition and valuation.

Just want to know why you believe it can be 3x in 3Y perspective?