How to Hunt Stocks Which are Worth Your Time and Not Duds

Issue #10 explores a systematic way to filter stocks having interesting business triggers and optionalities playing out

Most retail investors discover stocks the same way — through random news, social media chatter, or word-of-mouth. But this scattershot method leaves investors reacting to noise, often wasting hours of efforts into companies that aren’t worth the salt.

Not just retailers, we have known boutique firms employ this kind of trial and hit approaches, wasting mind-numbing analyst hours and resources. For example, we know of a firm which tracks 400+ companies every quarter, pouring through concalls and presentations.

We are not saying that is wrong but we find it wasteful given that probably 5-8 will make the bulk of thier portfolio.

The real question isn’t how to research — a vast swathe of stuff has been written on that. It’s what to research and where to find the signals is what matters. A list of 5 stocks with genuine catalysts is worth more than 30 with ‘twitteratti’ chatter.

This article is about building that discovery engine which enables investors to filter a focused shortlist worth deep diving for.

No more random scrolling. Let’s begin a smarter way to hunt.

But first:

What Are We Looking For?

We are looking for situations where there can be an ROCE expansion coupled with earnings growth which leads to valuation rerating. That is how you get multi baggers.

- Gautam Baid on Surge Capital’s podcast

What situations lead to both ROCE expansion and earnings growth?

Companies which have the following short-to-medium term business prospects:

Product Mix Change to higher margin products.

Operating Leverage which can come from high unutilised capacity just at the beginning of an industry up-cycle. Relevant for cyclical and commodity businesses.

Regulatory Change: Example looser regulations for micro finance players which led to higher TAM and consequently earnings.

Debt reduction: Lesser finance costs lead to higher net profits. Also as debt goes down capital invested goes down leading to higher ROCEs.

Working Capital Improvement: Lesser receivables or inventory holding days. Or negative working capital as in ecommerce.

Improvement in Asset Turns: Basically higher sales per unit of fixed assets.

Corporate Actions - demergers, merger arbitrage, promoter and management changes and divestiture of a low ROCE segment.

But How To Find Such Opportunities w/o Prior Research?

Via curated queries on www.screener.in and SEBI filings

We have converted each of the specific business situations into screener queries which you can find below:

1. The Turnarounds: Loss to Profit Makers

Turnarounds are distressed companies transitioning from losses to profitability through operational fixes, management changes, or industry recovery.

Screener Query:

2. Preferential Allotments

Preferential allotments to promoters signal insider conviction, often preceding operational turnarounds or aggressive growth plans that the market hasn't priced in yet.

Includes preferential issue of both shares and warrants

https://www.bseindia.com/corporates/ann.html

Note: The period between the ‘From Date’ and ‘To Date’ should not be greater than 1 month. Or else it will throw an error.

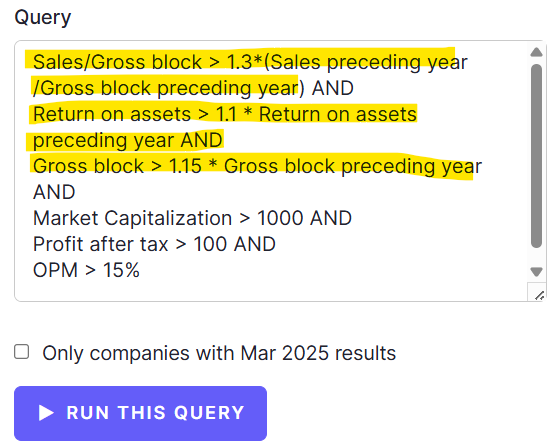

3. Capacity Expansion

Capacity expansion drives earnings growth by enabling higher sales volumes, better economies of scale, and potential market share gains when demand outpaces supply. We have deep-dived into the different faces of capex, a framework to compare one capex against another here.

Screener Query:

Note: OPM > 15% and profit last year is filtered to be positive so that the capex can be earnings accretive. Also Sales/ Gross Block is similar to the Net Asset Turnover Ratio.

4. Margin Expansion

A sign of margin expansion is when profits grow at a higher pace than revenue and when NPM tends to increase y-o-y. However, it is important to figure out if the expansion is due to a commodity upcycle (temporary) or product mix change (structural).

Screener Query:

Optional: You can add the following line to make the query more stringent:

Profit growth 3Years > Sales growth 3Years

5. Debt Reduction

Debt reduction lowers interest costs, improves cash flows, and strengthens balance sheets—freeing up capital for growth and unlocking potential valuation rerating.

Screener Query:

Here the query filters stocks where Current Debt is less than half of Debt 3 Years back. For more stricter measures you may also add:

Interest latest quarter < Interest preceding quarter

However, due to seasonal working capital requirements interests keep varying quarterly which may filter out potentially interesting companies. Hence we avoid using this in our filter.

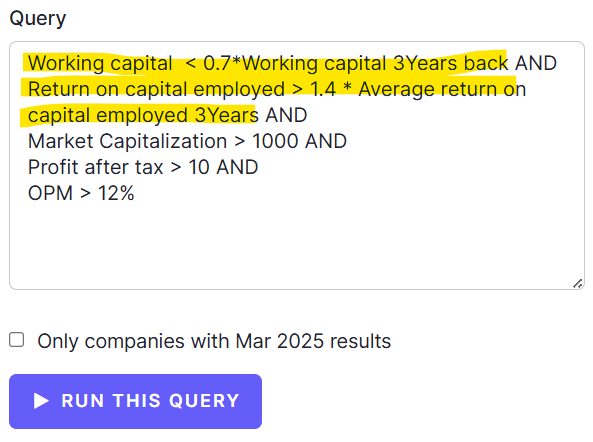

6. Working Capital Improvement

Working capital improvements boost cash flows, reduce borrowing costs, and enhance operational efficiency by optimizing inventory, receivables, and payables.

Less capital tied up in operations → higher free cash flows → improved ROIC and valuation upside.

Screener Query:

The query primarily filters out stocks where current working capital employed is less than 70% of WC required 3 years back + where current ROCE is 40% higher than last 3 years ROCE. Feel free to change these percentages as you’d like.

7. Promoter/FII/DII shareholding increase

Higher capacity utilization lowers per-unit costs, boosts margins, and signals strong demand - with little to no incremental capex.

Screeener Query (Promoters):

Query for FII/DII holding increase:

8. Corporate Action

This category includes demergers, large order receipts/ order books, promoter buying, revenue guidance, acquisitions, excellent results etc.

Sovrenn does a decent curation of the same. There are others such as R30 which provide a list of corporate actions, curated daily. We subscribe to it and would only recommend you if you are an active investor.

The post isn’t sponsored so the links are provided just for reference.

9. Analyst Upgrades

This is the least of our favorites. But a section of investors do follow analyst updates/upgrades on stocks. We find it limiting and biased hence avoid it. But folks who are interested can check it out at tickertape.

In the end, we would like to iterate that investors would find the most value if they start with our base queries and experiment with numbers and further parameters as per their requirements.

Until next time.

Amazing!